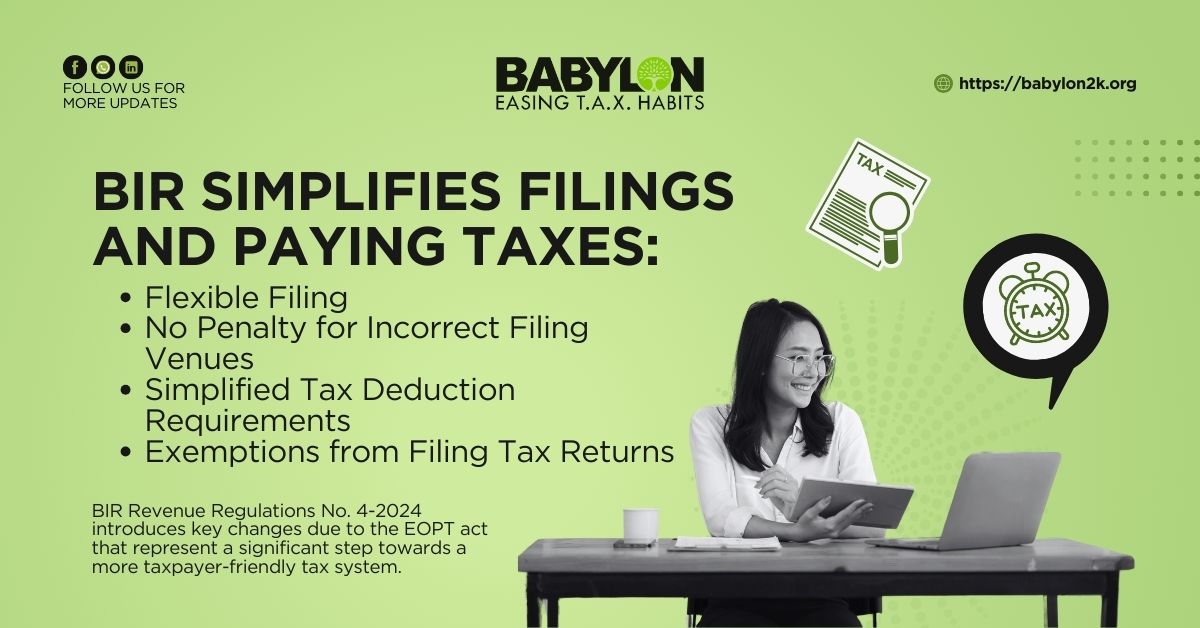

EOPT Alert: Our digest on the recently issued RR 4-2024 on filing and paying taxes anywhere

Introduction:

Great news for Filipino taxpayers! The Bureau of Internal Revenue (BIR) recently issued Revenue Regulations No. 4-2024, implementing key provisions of the Ease of Paying Taxes (EOPT) Act. This translates to more straightforward tax filing and payment processes for you!

Key Benefits of RR No. 4-2024:

- File Electronically or Manually (Without Penalty): You can now file your tax returns and pay your dues electronically or manually, whichever is more convenient. Plus, there are no penalties for incorrect filing venues.

- Reduced Requirements for Tax Deductions: The new regulation makes claiming deductions easier by removing extra requirements.

- Exemptions from Filing Tax Returns for Filipino Workers (OFWs) & Minimum Wage Earners

- Clearer Withholding Tax Guidelines: No more confusion about when taxes must be withheld.

Breakdown of Key Sections:

- Section 1: Outlines the scope of the regulations, detailing both electronic and manual filing and payment methods, and the promulgation to implement key provisions regarding electronic or manual filings, elimination of penalties for incorrect venue filings, non-filing for OFWs, simplified deductions, and standard withholding procedures.

- Section 2: Defines key terms used within the regulations, including:

- “Filing of Return” refers to submitting prescribed tax returns electronically or manually.

- “Payment of Tax” involves the delivery of tax dues via electronic or manual methods.

- “Authorized Agent Banks (AABs)” are financial institutions accredited to collect tax payments.

- “Revenue Collection Officers (RCOs)” are BIR officers accepting tax payments under certain conditions.

- “Authorized Tax Software Provider (ATSP)” refers to entities providing electronic tax filing and payment solutions.

- “Overseas Filipino Worker (OFW)” includes Filipinos working abroad, subject to specific tax rules.

- Section 3: Describes the modes of tax return filing and payment, emphasizing flexibility in electronic and manual processes. “Electronically” means using the BIR’s electronic platforms, while “manually” involves submission and payment through physical means at authorized locations.

- Section 4: Removes the 25% surcharge or civil penalty for filing tax returns at an incorrect venue, mitigating a common taxpayer issue.

- Section 5: Lists individuals exempt from filing income tax returns, detailing:

- Individuals earning below a specified threshold.

- Employees whose tax has been correctly withheld.

- Individuals whose sole income has been subjected to final withholding tax.

- Minimum wage earners.

- Overseas Filipino Workers (OFWs) not required to file due to their earnings abroad.

- Section 6: Eliminates additional requirements for the deductibility of certain payments, simplifying the tax deduction process.

- The EOPT Act removes the “Additional Requirements for Deductibility of Certain Income Payments” previously outlined in Section 34(K) of the Tax Code. Previously, one of these requirements, states that an expense will be allowed as a deduction for income tax purposes only if it is shown that the tax required to be deducted and withheld therefrom has been paid to the BIR. stated that an expense could only be deducted if the withholding tax was demonstrably paid to the BIR. This change means businesses no longer need to meet these additional requirements to deduct certain payments from their taxable income. However, the obligation to withhold tax on these payments still remains.

- Section 7: Clarifies the timing for tax withholding, ensuring clarity on when taxes must be withheld from payments. Previously, it wasn’t entirely clear. Section 2.57.4 of RR No. 2-98, as amended, shall now read as follows:

- When the income becomes due, demandable, or legally enforceable. (Think of this as the official due date for the payment.)

- When the income payment is recorded as an expense or asset in the payer’s books. (This refers to the internal accounting records of the business making the payment.) OR

- When the seller issues a sales invoice or other supporting document for the payable. (This applies when the income relates to selling goods or services.)

- Section 8: Details the tax obligations for recipients of income subject to withholding, including provisions for tax refunds.

- The regulation reiterates the existing process for tax refunds. Any income tax withheld at source is considered a credit for the recipient. This means the recipient includes the income in their tax return, but they can claim a refund for any excess tax withheld compared to their actual tax liability. Section 204 of the Tax Code outlines the specific procedures for claiming tax refunds.

- Section 9: Contains a separability clause, ensuring that if parts of the regulation are invalidated, other sections remain effective.

- Section 10: States the repealing clause, overriding previous conflicting regulations.

- Section 11: Establishes the effective date of the regulations, set 15 days after publication (from April 12, 2024).

The Bottom Line:

These new regulations represent a significant step towards a more taxpayer-friendly tax system. Babylon2k is here to help you navigate the changes and ensure you take advantage of the simplified processes.

Babylon2k’s tax and compliance services can help you navigate your finances effectively. Our team of experts will guide you toward informed financial decisions that pave the way for success. We offer:

- Tax Filing and Compliance (ITR preparation packages, 1709 preparation, Tax compliance review & planning, U.S. Tax return preparation and filing, etc…) – Service Codes: GG0010, GG0040, GG0130, GG0170, etc.

Whether you’re an entrepreneur, a remote employee, or a small business owner, Babylon2k offers a customized service that meets your needs. Each service has a corresponding service code (e.g., 110010, 110040). When you’re ready to get started, simply request a quote and enter the relevant service code(s) to ensure we can connect you with the perfect Babylon2k specialist for your needs.

Do you want to know more about how we can help? It’s easy!

- Tutorial on Requesting a Quote

- Schedule a FREE DEMO & CONSULTATION

- Contact us through chatbot or Viber/Whatsapp Number @ +63-927-945-3382.

- Email Babylon2k directly at [email protected]