Enterprise Risk Management (ERM) is a systematic approach that helps organizations identify, assess, and manage risks. It aims to protect assets, support strategic goals, and ensure operational stability.

Unlike traditional risk management, which focuses on specific risks, ERM considers a broader view, addressing risks across the entire organization.

In this article, we’ll discuss what ERM is, its key components, and why it’s important for businesses.

What is Enterprise Risk Management?

ERM is a strategic framework used by businesses to manage all types of risks—financial, operational, strategic, and compliance-related. The goal is to minimize potential negative impacts while identifying opportunities for growth.

ERM involves a top-down approach, integrating risk management into corporate strategy, decision-making, and culture. This holistic perspective allows companies to address interconnected risks and make more informed decisions.

8 Key Components of Enterprise Risk Management

The COSO (Committee of Sponsoring Organizations) ERM framework outlines eight essential components for implementing effective Enterprise Risk Management. These components work together to create a structured process for identifying, assessing, managing, and monitoring risks throughout the organization.

1. Internal Environment

The internal environment sets the foundation for how risk is managed within an organization. It includes the company’s risk culture, ethical values, and overall attitude toward risk. A positive risk culture encourages open communication about risks and supports the development of policies and processes that align with the organization’s goals.

Leadership plays a critical role in shaping this environment, establishing a tone that supports risk awareness.

2. Objective Setting

Objective setting ensures that the organization’s goals align with its risk appetite. By clearly defining objectives at both strategic and operational levels, companies can identify the risks that might impact their ability to achieve these goals.

The objective-setting process helps in determining the risk tolerance levels and aligning them with the overall strategy. This alignment is crucial for ensuring that risk management supports, rather than hinders, the achievement of business targets.

3. Event Identification

Event identification involves recognizing internal and external events that could affect the organization’s objectives. These events may pose risks or present opportunities, depending on their potential impact. Identifying events early helps the organization to prepare and respond effectively, minimizing disruptions.

Techniques like brainstorming sessions, SWOT analysis, and industry trend analysis can aid in this process, ensuring a comprehensive view of possible events.

4. Risk Assessment

Risk assessment evaluates the likelihood and potential impact of identified events. It uses qualitative and quantitative methods, such as probability assessments, risk matrices, and scenario analysis, to prioritize risks.

This process helps organizations focus on high-priority risks that could have the most significant impact. A thorough risk assessment allows businesses to allocate resources efficiently and develop targeted mitigation strategies.

5. Risk Response

Risk response involves developing strategies to address identified risks based on their severity and likelihood. Responses may include avoiding, reducing, sharing (transferring through insurance), or accepting risks.

Each response is designed to align with the organization’s risk appetite and overall objectives. The goal is to balance risk-taking with risk mitigation, ensuring that the organization remains within its acceptable risk tolerance.

6. Control Activities

Control activities are the policies, procedures, and actions that help ensure risk responses are properly executed. These activities can include both preventive and detective measures, such as segregation of duties, regular audits, and authorization controls.

Control activities are embedded in the organization’s daily operations to provide ongoing assurance that risk management processes are functioning as intended. They are crucial for maintaining consistency and accountability in how risks are managed.

7. Information & Communication

Effective information and communication ensure that all stakeholders, including employees, management, and the board, are aware of the risks the organization faces. This involves providing timely, relevant, and accurate information about risk management processes and the status of current risks.

Clear communication channels allow for the free flow of information, helping the organization to respond quickly to emerging risks. It also ensures that stakeholders can make informed decisions based on the latest risk data.

8. Monitoring

Monitoring involves ongoing evaluation of the entire ERM process to ensure that it remains effective over time. This includes both regular reviews and real-time monitoring of risks and control activities.

Internal audits, performance metrics, and external reviews can provide valuable insights into how well the ERM process is working. Effective monitoring helps organizations adjust their strategies and controls as needed, adapting to changes in the risk landscape and improving overall risk management.

Why is Risk Management Important for Businesses?

Risk management is essential for maintaining stability and achieving long-term success. Without effective risk management, organizations may face unexpected disruptions, financial losses, or damage to their reputation.

ERM helps protect assets by safeguarding both financial and physical resources from various threats like fraud, cyber-attacks, and market volatility. It also supports strategic objectives, aligning risk management efforts with the company’s goals, helping to meet targets more effectively.

Moreover, ERM improves decision-making. By understanding the nature and potential impact of risks, businesses can make more calculated decisions, avoiding pitfalls while taking advantage of growth opportunities.

Additionally, it enhances compliance by keeping companies in line with regulations and industry standards, reducing the risk of legal issues and penalties.

What are the Objectives of Risk Management?

The objectives of ERM extend beyond avoiding losses. They focus on creating a resilient organization that can adapt to change and capitalize on opportunities.

A core objective is to minimize losses by identifying risks that could lead to financial or operational setbacks and implementing measures to prevent them.

ERM also aims to improve resource allocation by focusing efforts where they are most needed, ensuring that critical risks are managed effectively.

Building resilience is another key goal. This means developing the capacity to respond quickly to unexpected events, minimizing disruption to operations.

Finally, ERM aims to enhance stakeholder confidence. By demonstrating a proactive approach to managing risks, organizations can foster trust with investors, customers, and employees, reinforcing their reputation for stability and reliability.

Examples of Enterprise Risk Management

Effective ERM practices vary by industry, with each organization tailoring their approach to specific needs.

In manufacturing, for example, ERM can help manage supply chain disruptions, ensuring that production continues smoothly despite delays or shortages. A global manufacturer might diversify suppliers or create inventory buffers to avoid interruptions.

In the financial services industry, ERM often focuses on managing regulatory risks, such as new compliance requirements, and operational risks like cybersecurity threats. This ensures that banks remain compliant while protecting customer data.

Tech companies, on the other hand, may prioritize managing risks related to intellectual property, data breaches, and rapid technological changes that could impact their product lines.

What are the Most Common ERM Frameworks?

Several frameworks guide organizations in implementing ERM effectively. These frameworks provide structured methods for identifying and managing risks.

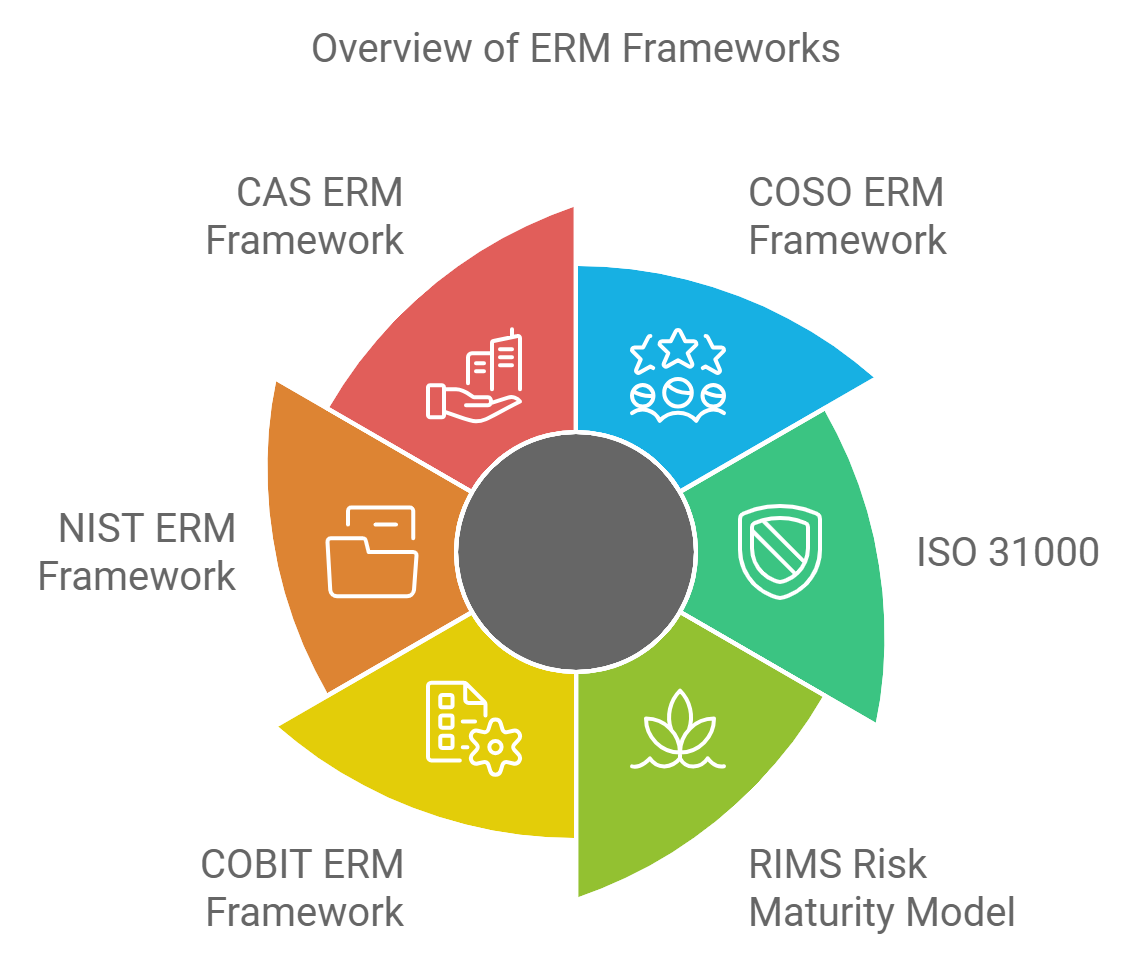

Overview of ERM Frameworks

COSO ERM Framework

The Committee of Sponsoring Organizations (COSO) ERM framework is one of the most widely adopted models. It focuses on integrating risk management with the organization’s strategic goals.

The framework outlines eight components, including internal environment, objective setting, risk assessment, and monitoring. It is especially known for emphasizing a strong internal control environment and fostering a risk-aware culture across all levels of the organization.

The COSO framework is often chosen by organizations looking for a comprehensive approach to managing both risks and opportunities.

ISO 31000

ISO 31000 is an international standard providing guidelines for developing and maintaining a risk management process. It is more adaptable than COSO, allowing companies to tailor its principles to their needs. It emphasizes the role of leadership in building a risk-aware culture and focuses on continuous improvement.

ISO 31000 is widely applicable across industries, making it a versatile choice for organizations seeking flexibility. It promotes a cyclical risk management process, adapting to evolving business needs.

RIMS Risk Maturity Model

The RIMS Risk Maturity Model helps organizations assess the maturity and effectiveness of their risk management practices. It focuses on six key attributes, such as ERM process management and risk appetite.

Companies use this model to benchmark progress, identify gaps, and prioritize improvements.

The model provides a path from basic to advanced risk management capabilities. It’s ideal for organizations looking to integrate risk management into strategic decision-making.

COBIT ERM Framework

COBIT (Control Objectives for Information and Related Technologies) is a framework developed by ISACA, specifically aimed at managing IT-related risks.

The COBIT ERM framework focuses on aligning IT with business goals, ensuring that technology risks are integrated into the broader risk management process. It helps organizations manage information security, data privacy, and compliance with regulations.

COBIT is especially relevant for organizations with significant reliance on IT systems, providing a structured approach to managing risks related to technology and digital transformation.

NIST ERM Framework

The National Institute of Standards and Technology (NIST) ERM framework is often used by organizations to manage cybersecurity risks. It offers guidelines and standards that help organizations assess and mitigate risks related to data security and IT systems.

NIST’s framework emphasizes continuous monitoring and adaptive risk management, making it particularly effective in environments where threats evolve rapidly.

While NIST is primarily used in government and critical infrastructure sectors, its principles can be applied to any organization looking to strengthen its cybersecurity posture.

Casualty Actuarial Society (CAS) ERM Framework

The Casualty Actuarial Society (CAS) developed an ERM framework that focuses on quantitative risk assessment methods, making it particularly relevant for the insurance industry and financial services.

The CAS framework emphasizes the use of actuarial science and statistical models to evaluate risks and their financial impact. It helps organizations understand the potential variability in outcomes and supports better decision-making around risk retention, transfer, and mitigation.

This framework is ideal for companies that need to model complex risks, such as those involving catastrophic events or large portfolios of policies.

Enterprise Risk Management FAQs

How is ERM different from traditional risk management?

ERM takes a holistic approach, addressing risks across the entire organization, while traditional risk management focuses on specific areas like safety or finance. ERM integrates risk management into strategic planning, making it more proactive. Traditional methods often operate separately and may focus on reacting to incidents. ERM considers how different risks interact and affect overall business goals.

Who should manage ERM in an organization?

The board of directors, senior management, and the enterprise risk management team (ERMT) are responsible for managing ERM. While the ERMT oversees daily risk management activities, senior management ensures that ERM aligns with strategic goals. The board provides oversight and supports a risk-aware culture within the organization.

What are the challenges of enterprise risk management?

Common challenges include cultural resistance, as some employees may be reluctant to adopt new processes or report risks. Data quality is also crucial, as poor data can lead to inaccurate risk assessments. Smaller organizations may struggle with resource constraints for implementing ERM. Additionally, managing the complexity of interconnected risks can be difficult.

Maximize Your ERM Success with Babylon2k’s Consultancy Services

Implementing Enterprise Risk Management (ERM) can transform how your business handles risks, but it requires the right expertise.

Babylon2k’s consultancy services provide tailored guidance, helping you integrate ERM frameworks into your operations seamlessly. With our support, your organization can better identify, assess, and respond to risks, ensuring long-term stability and growth.

Don’t navigate ERM alone. Request a quote today and let us equip you with the strategies and tools needed for effective risk management.

For more inquiries, message our AI chatbot, email us at [email protected], or contact us via Viber/WhatsApp at +63-927-945-3382.