The Christmas season is just around the corner, and Filipino employees now look forward to one of their most-awaited year-end benefits: the 13th-month pay. To many, it is known as a mandatory payout. Yet, some still misunderstand how it works, who is entitled, and how it should be computed.

Let’s break down everything that needs to be known, along with insights from the Department of Labor & Employment (DOLE) guidelines and labor law interpretations.

What Is the 13th Month Pay?

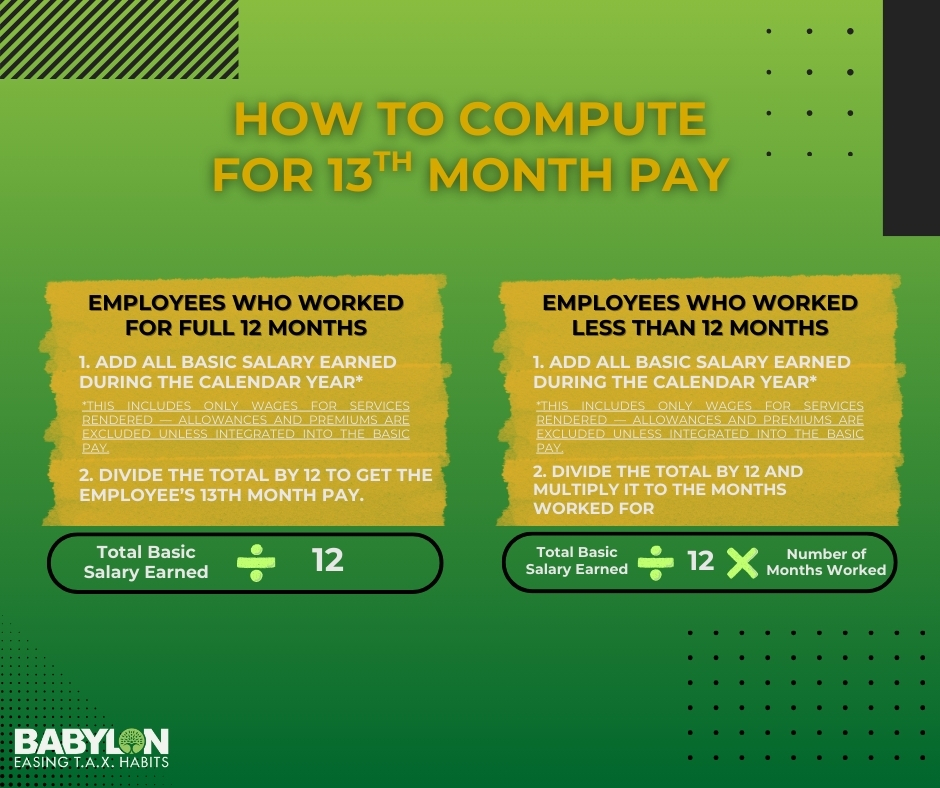

The 13th-month pay is a mandated benefit under Presidential Decree No. 851. It requires all private-sector employers to provide the rank-and-file employees with an additional compensation equivalent to one-twelfth (1/12) of their total basic salary within the calendar year.

It is essential to distinguish 13th-month pay from bonuses, as bonuses are discretionary and may or may not be given by the employer, depending on company policy. However, the 13th month is mandatory under the law and must be given not later than December 24 every year — even if such employees did not work the full 12 months, they are still entitled to a pro-rated amount.

Additionally, the labor law clarifies that “basic salary” refers strictly to pay for services rendered. It excludes overtime, night differential, holiday pay, unused leave conversions, and allowances. The exception to this is unless those allowances are built into the employee’s basic wage through a company agreement or policy.

Who is Entitled to Receive It?

As earlier mentioned, all rank-and-file employees in the private sector, regardless of employment type, are entitled – whether they are:

- Regular

- Probationary

- Casual

- Project-based

- Seasonal

- Fixed-term

The only requirement that they must meet to be entitled is to work at least one month within the calendar year. Employees who are paid purely based on commission, task-based, or who receive remuneration not based on rendered time may be subject to exemptions. Additionally, under the law, even resigned or terminated employees are still entitled, but only for the period during which they actually rendered services.

On the other hand, government employees do not fall under PD 851, instead, they receive their own year-end bonus under a separate law.

How to Compute the 13th Month Pay

Understanding the computation helps employees avoid underpayment and helps employers stay fully compliant. Here’s the breakdown:

- Paid leave may not always count toward “earned basic salary” under company policy.

- The full amount must be paid on or before December 24, although employers may choose to release it in two portions earlier in the year.

With proper computation, it helps avoid disputes, ensures payroll processing accuracy, and empowers employees to verify they’re receiving the correct amount.

Why the 13th Month Pay Matters

Besides the holiday expectation of receiving an incentive, the 13th-month pay serves as a major financial and legal purpose for both employees and employers.

- Provides significant financial support for December expenses or can be part of savings.

- Helps employees ease their debt, build emergency funds, or cope with the cost-of-living pressures, especially as prices rise during the holiday season.

- Reinforces fair wage practices and supports the welfare of rank-and-file workers.

- Ensures strict employer compliance under PD 851, since DOLE does not allow non-payment or deferral.

- Requires employers to submit a DOLE Establishment Report by January 15 for compliance.

With its social, economic, and legal impact, the 13th-month pay stands as one of the strongest worker protections in the Philippines.

Common Issues and Mistakes to Watch Out For

Despite clear rules, many employers and employees still encounter errors regarding 13th-month pay. Here are the most common pitfalls and how to avoid them.

- Misunderstanding of “basic salary” – Some include allowances, overtime, or night differentials, which leads to inaccurate computation.

- Incorrect pro-rated computation for resigned, terminated, or newly hired employees

- Late release, which violates DOLE’s December 24 deadline.

- Tax errors — remember that only the amount exceeding ₱90,000 (combined with bonuses) is taxable.

- Failure to submit the DOLE report by January 15.

- Diminution of benefits — if a company historically gave higher 13th-month pay amounts, reducing them may constitute a violation of labor law.

- Ambiguities in contracts — unclear wording is interpreted in favor of employees.

Avoiding and noting these mistakes not only protects employee rights but also shields employers from legal disputes and DOLE sanctions.

Final Thoughts

The 13th-month pay is more than a year-end incentive for rank-and-file employees — it is a legally enforceable safeguard that supports workers and upholds fairness in compensation. By knowing who is entitled, how it’s computed, and the common issues, both employees and employers can ensure smooth, compliant, and transparent processing each year.

If you want your 13th-month pay computation to be accurate, compliant, and hassle-free, Babylon2k is here to help. Our team provides end-to-end assistance — from verifying employee eligibility and reconciling payroll records to ensuring full compliance with DOLE rules and addressing disputes or irregularities. Reach out to us at [email protected], book a consultation, or request a quote to ensure your company is compliant with regulations and computations for the upcoming year-end incentive.

Disclaimer: Information shared for educational purposes only.