For many business owners, nothing feels more worrisome than receiving a Letter of Authority from the Bureau of Internal Revenue (BIR). Indeed, technical terms like tax deficiency, assessments, and penalties arise, and the panic will ensue, even if businesses are compliant.

But, here’s a myth we will debunk: A BIR Audit does not mean you have already done something wrong in tax compliance. Instead, it is a standard procedure under the provisions of the National Internal Revenue Code (NIRC) that gives the BIR the authority to examine or check how you process your returns.

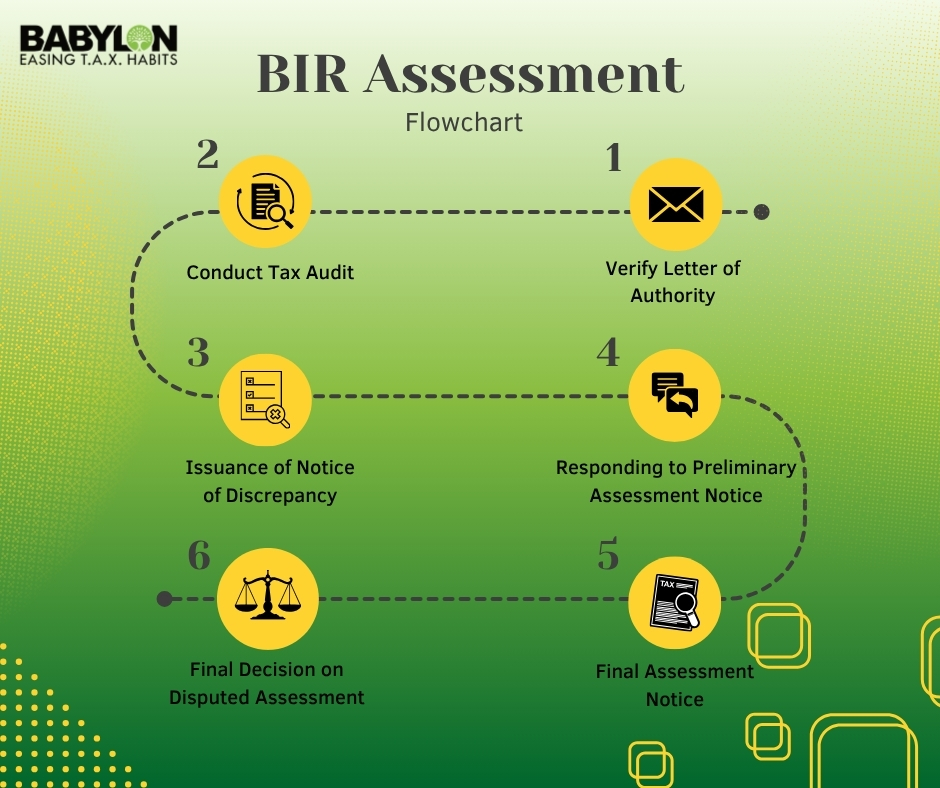

Understanding the process and knowing your rights can transform fear into control, ultimately ensuring compliance. Let’s break down the six fundamental steps of the BIR assessment process.

Step 1: The Letter of Authority (LOA)

The Letter of Authority (LOA) is a formal notice that the BIR will examine your books of accounts, receipts, related documents, and tax returns.

Now, what must it contain? It must clearly indicate:

- The tax types subjected to audit, such as Income Tax, Value-Added Tax, or Withholding Tax

- The taxable period that will be covered (common encounters are one fiscal year), and

- The name of the Revenue Officers authorized to conduct the audit

- Signature of the Regional Director

The LOA must be served within 30 days from its issuance date, otherwise, it becomes void. Without a valid LOA, any assessment or examination by the BIR is void. It lays the foundation of the entire audit process and must be received by the taxpayer who is the subject of the audit.

What you should do:

- Verify the document – Check and ensure that the Regional Director signs it and that the Revenue Officers named are the ones handling your case or situation.

- Organize your records – Gather your books of accounts, BIR filings, receipts, invoices, and other necessary documents within 10 days from the date the LOA was received.

- Keep track of all notices and deadlines – Document the date you received the LOA, as this starts the 120-day audit period. Also, track any document requests, compliance notices, or subpoenas issued during the audit, as timely submission strengthens your side.

What happens if you ignore the LOA and don’t submit the documents needed?

- The BIR may proceed with the audit based on available information or the best evidence obtainable, and the audit will continue regardless, but without your input to guide it.

- You lose the opportunity to present your side early and clarify discrepancies.

- After the second or final notice, failure to submit documents may result in the BIR issuing assessments based on incomplete or presumed information.

Tip: Only one LOA should be issued per taxable year. If revenue officers are reassigned, a valid replacement of LOA must be issued stating the number it replaced, and for the audit to be continued.

Step 2: The Tax Audit

Once the LOA is received and you have verified its authenticity, the assigned Revenue Officer has 120 days from the date of receipt to conduct the audit and submit the required report of investigation.

During this stage, the BIR will:

- Review your financial records, books of accounts, and supporting documents

- Verify tax returns against actual transactions

- Identify any discrepancies or areas of concern

What you should do:

- Cooperate fully – Submit requested documents promptly after the second or final notice

- Maintain organized documentation – Clear documentation makes the process smoother

- Track the timeline – The 120-day period is critical; note when it expires

What happens when you don’t cooperate during the audit?

- The Revenue Officer will complete the audit using the available information.

- You lose the chance to explain transactions or provide context that could prevent findings.

- The non-submission of complete documents amplifies the BIR’s position in such disputes.

Tip: You may request an exit conference once the audit is done to clarify their findings before any formal assessment is issued. This is an opportunity to fix misunderstandings as early as possible.

Step 3: The Notice of Discrepancy

If the audit reveals such issues, the BIR will then issue a Notice of Discrepancy outlining its findings and the identified deficiency taxes.

What It Contains:

- Specific discrepancies found during the audit

- Preliminary computation of deficiency taxes, including penalties, surcharges, and interests.

- Basis for the findings

Within 30 days from receipt of the NOD, there must be a discussion where you can present your side, explain discrepancies, and provide supporting documents.

What You Should Do:

- Attend the NOD discussion – This is your opportunity to clarify misunderstandings and present evidence

- Present supporting documents – Receipts, contracts, bank statements, or any evidence that supports your position or claims

- Take it seriously – Your response here can significantly impact the following steps and can make or break a cause.

What happens if you disregard the Notice of Discrepancy?

- The BIR will proceed to issue the Preliminary Assessment Notice (PAN) based on their initial findings without your explanations.

- Discrepancies that could have been explained with proper documentation will remain on record.

- The assessment process moves forward with their version of facts.

Tip: If you can resolve discrepancies during this discussion phase with solid documentation that is based on facts and evidence, you may prevent the issuance of a preliminary assessment.

Step 4: The Preliminary Assessment Notice

If the NOD doesn’t lead to resolving the issues at hand, the BIR will issue a Preliminary Assessment Notice (PAN) — which is essentially a draft finding for your business.

This document contains:

- The discrepancies found, such as unreported taxable income, disallowed deductible expenses, or unremitted withholding taxes, etc.

- The initial computation of deficiency taxes, inclusive of the surcharges, interest, and penalties applicable

- The legal basis for the findings and computations

The BIR must issue the PAN within 10 days from the end of the NOD discussion. You have 15 days from receipt to submit a written reply. The PAN is not yet final or executory, but your response to that notice can worsen or ease the case you are currently in.

What You Should Do:

- Submit a written reply – This is an opportunity for you to present further explanations, reconciliations, or supporting documents regarding the initial finding.

- Consult with a tax expert – the manner of explanation is so crucial that even minor mistakes in word usage can influence how the BIR interprets your defense.

What happens if you don’t respond to PAN within 15 days?

- It may be considered a waiver of your right to contest the preliminary assessment and agree to their draft finding.

- The assessment escalates to the next level with higher stakes, and the BIR will proceed to issue a Formal Assessment Notice (FAN) based on their computation.

Tip: Always respond. Even a simple clarification letter can prevent the issuance of a Formal Assessment Notice.

Important Note: PAN is not required for mathematical errors, discrepancies between withheld and remitted taxes, or certain specific cases outlined in the NIRC.

Step 5: The Formal Assessment Notice (FAN)

Suppose your explanation and submission of the necessary documents regarding the PAN don’t resolve the issues. In that case, the BIR will issue a Formal Assessment Notice (FAN), also known as a Final Letter of Demand (FLD).

This is the official declaration that the BIR believes you owe the government deficiency taxes or penalties for non-compliance with their regulations, along with additional surcharges, interest, and penalties.

What it must contain:

- Taxpayer’s name, address, and TIN

- Period covered

- Factual and legal basis for the assessment

- Basic tax and penalties with definite amounts

- Due date for payment

You have 30 days from receipt to file a protest. Missing this deadline means the assessment becomes final, executory, and demandable by the BIR.

What You Should Do:

- File a protest immediately within 30 days — choose between a request for reconsideration (based on existing records) or a request for reinvestigation (if submitting new evidence, which you’ll have 60 days to provide after filing your protest)

- Ensure your protest is filed in writing and done within 30 days — missing the deadline means the assessment becomes final and executory, in which it will be deemed as too late to defend your side regarding their administrative sanction.

- Keep proof of filing — any receipts, acknowledgment copies, registry slips must be kept, as time is of the essence in this situation.

What happens if you don’t protest the FAN within 30 days?

- You can no longer contest the assessment administratively or judicially

- The assessment becomes final, executory, and demandable without the issuance of an FDDA.

- Once the FAN becomes final, the BIR may issue a Warrant of Distraint or Levy, which can result in the freezing of bank accounts or the seizure of property to satisfy tax liabilities.

Tip: Never ignore a FAN-FLD, respond immediately with the help of a CPA or tax representative.

Important Note: The FAN must be issued within the 3-year prescriptive period (or 10 years for fraud cases). Also, a FAN without a definite tax amount or factual/legal basis is void, and the assessment must include a demand to pay to be valid.

Step 6: Final Decision on Disputed Assessment (FDDA)

After filing your protest regarding the FAN-FLD, the BIR has 180 days to resolve your case or take action on it.

The FDDA contains:

- The BIR’s decision on your protest

- Approval, rejection, or modification of the assessment

- Legal and factual basis for the decision

Issued By:

- Regional Director (for regional cases)

- Commissioner of Internal Revenue (for Large Taxpayer cases)

You have the following options after receiving the FDDA:

- If the BIR issues an unfavorable decision, you have 30 days from receipt to appeal to the Court of Tax Appeals (CTA).

- If the Regional Director issued the decision, you may appeal directly to the CTA or first seek reconsideration from the Commissioner. If you choose to appeal to the Commissioner, you must await their decision before proceeding to the CTA.

- If the BIR takes no action within the 180 days, you have 30 days from the expiration of that period to appeal directly to the CTA. Alternatively, choosing to wait for the BIR can result in increased interest charges. If their decision is adverse, you will have 30 days to appeal directly to the CTA.

Regardless of the options you chose, it’s crucial to have coordination between your legal and accounting teams. Documentation and strategy must align to achieve what is written in the provisions of law. The CTA handles appeals based strictly on evidence, procedure, and timeliness.

What happens if you don’t appeal the FDDA within 30 days?

- The FDDA is deemed to be final and executory.

- You waive your right to elevate the case to the Court of Tax Appeals

- The BIR will enforce the assessment as determined in the FDDA

Tip: Keep all correspondence, proof of delivery, and copies of every document submitted. Proper documentation can assist you in court matters.

Your Rights during a BIR Audit Process

Under the provisions of the Taxpayer’s Rights under our Philippine Tax Law, you are protected from abuse and entitled to transparency throughout the audit process. To further elaborate on its salient features, you have the right to:

- Be informed of the exact legal basis of any assessment

- Receive copies of all working papers used in the audit

- Be represented by a CPA, tax consultant, or lawyer

- Confidentiality: Your records cannot be disclosed to third parties without your consent, and ultimately;

- Due process: No tax may be collected without a valid assessment and opportunity to contest on your behalf

The BIR must adhere to the prescribed rules and regulations. The courts can invalidate assessments based on mere assumptions or unverified information from third parties.

Final Thoughts

A BIR audit is designed to promote compliance and transparency. Still, many businesses get penalized not because of fraud, but due to a lack of documentation, missed deadlines, or even the simplest form of misunderstandings.

What is the best strategy to use?

- Keep clean, organized books – Proper documentation is your first line of defense

- Respond promptly – Never miss a deadline, as silence can be costly

- Seek professional help early – A CPA or tax consultant can help you navigate each step properly

- Know your rights – Understanding the process empowers you to protect your business

If your business recently received an LOA or audit notice, don’t panic — act wisely.

Contact Babylon2k today to receive professional assistance with managing BIR audits, protests, and tax compliance, allowing you to focus on growing your business while we handle the complexities.

Disclaimer: Insights provided by our in-house Tax Department, guided by Atty. Charles Agunos. Information shared for educational purposes only.