Some business owners believe that delaying accounting or compliance support saves money. Monthly retainers, consultation fees, and audit costs can feel like avoidable expenses, especially for start-ups and growing Small and Medium Enterprises (SMEs) managing tight cash flow.

However, this stance often creates a dangerous blind spot. In reality, non-compliance leads businesses to incur compounding financial penalties — harming operations, causing reputational damage, and missing out on the best opportunities. What initially seems like “savings” often becomes a much larger, more expensive problem.

Compliance should not be viewed as a burden; rather, it is a strategic investment towards business stability, credibility, and long-term scalability.

An Actual Look at Government Penalty Collections

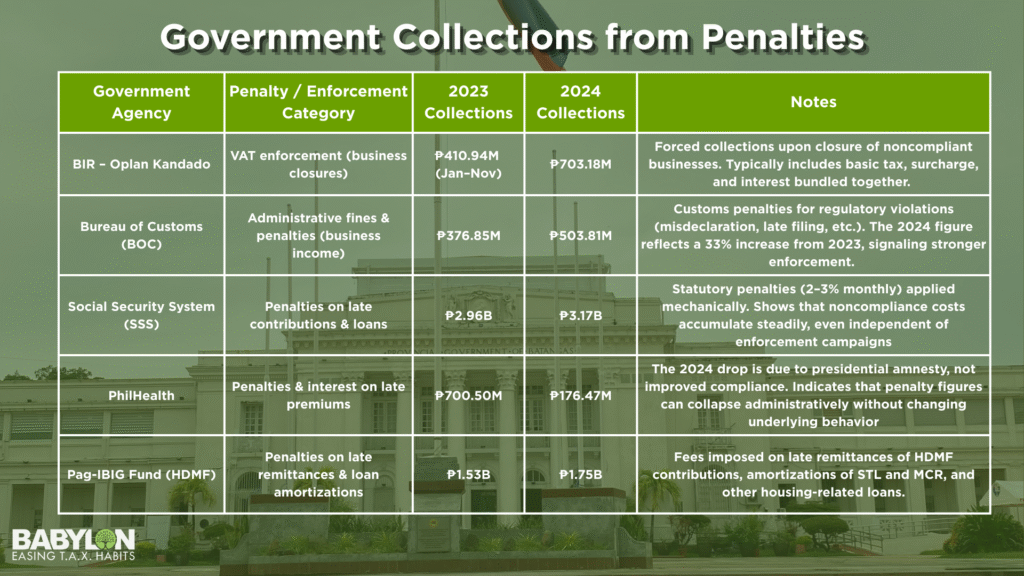

Non-compliance is not just a regulatory concept — it has a measurable financial impact on Philippine businesses. Government agencies collect millions to billions of pesos annually from penalties, surcharges, interest, and enforcement actions arising from late filings, unpaid contributions, reporting violations, and regulatory breaches.

Based on audited financial statements, COA audit reports, and official enforcement disclosures, several agencies publicly report the amounts they actually collected, not merely assessed, from penalties and related enforcement activities. In some cases, penalties are disclosed as standalone line items (e.g., SSS and PhilHealth), while in others, penalties are embedded within broader enforcement or business income accounts (e.g., BIR, BOC, and Pag-IBIG).

Despite differences in reporting formats, one reality remains: Non-compliance generates substantial cash outflows for businesses, which is money that could otherwise be reinvested in growth, operations, and innovation.

The table below summarizes the available figures and verified enforcement-related collections from selected government agencies for 2023 to 2024.

Note: Some agencies consolidate penalties within broader revenue categories rather than publishing them as standalone totals. The figures reflect officially reported enforcement or audit-related collections that include penalty components.

Understanding the Real Financial Impact of Non-Compliance

Regulatory compliance is not optional. In the Philippines, government agencies such as the Bureau of Internal Revenue (BIR), the Securities and Exchange Commission (SEC), and Local Government Units (LGUs) impose strict filing and compliance requirements and documentation standards. Even minor infractions can trigger penalties that can further escalate if ignored.

Underestimating how quickly penalties can accumulate is a common trap that businesses often overlook. Some of the usual violations are:

- Late or Non-filing of Tax Returns — failure to file the appropriate income tax, VAT, withholding, or percentage taxes can result in surcharges that may reach up to 25% of the basic tax due, monthly interest that accrues until full settlement, compromise penalties depending on the nature of the violations, and potential auditing & expanded assessments. Indeed, a single missed return may seem manageable, but multiple missed filings compound quickly and restrict cash flow.

- Incorrect or Incomplete Books of Accounts —improper bookkeeping creates a long-term exposure to disadvantages. It can lead to disallowed expenses during tax audits, reclassification of transactions that result in further tax assessments, difficulty defending positions during audits or regulatory reviews, and reduced credibility with banks and investors.

- Non-compliance with SEC Reporting — late or incomplete submission of General Information Sheets (GIS), Audited Financial Statements (AFS), and Beneficial Ownership Disclosures may result in monetary penalties, suspension of corporate registration, delay in license renewals & business transactions, and lessen trust from partners and other institutions.

- Payroll, Withholding, and Statutory Contribution Errors — errors in payroll compliance expose businesses to underpayment assessments, employee disputes and reputational issues, back taxes with penalties and interest, and administrative disruptions.

These issues often surface years later, when correction becomes far more expensive due to compounded financial penalties, lost opportunities, and disruptive procedures that can affect the usual course of business.

Impact of Hidden Costs

Beyond direct financial penalties, non-compliance also incurs indirect losses that quietly undermine performance. Such hidden costs that cannot be simply quantified are:

- Lost Executive and Management Time — instead of focusing on growth, managers or leaders spend much time responding to notices, compiling documents, having meetings with regulators, and correcting historical records. The time spent on these matters drains the momentum for strategy formulation and business management.

- Delayed Financial and Investment Opportunities — Investors, institutional partners, and banks typically require up-to-date financial statements and regulatory compliance documentation to assess the business’s reliability. Any red flags or issues often lead to delays and even the cancellation of funding opportunities.

- Operational Disruptions — Suspended registrations, delayed permit approvals, frozen accounts, and forced reconciliations disrupt business operations, which can lead to unsatisfied customers and reputational issues.

- Slower Scalability — business expansion, franchising, mergers & acquisitions, and government bidding require clean financial and compliance records. Weak documentation and exposure to litigation risks limit a business’s potential to expand.

These hidden costs often exceed the original penalties, underscoring that this is not only a quantifiable concern but also a qualitative aspect that should not be overlooked.

Real-World Business Scenarios (Illustrative Examples)

Here are some of the illustrative scenarios that are typically encountered by businesses:

Scenario 1: The Growing Startup – A startup delayed formal bookkeeping to reduce monthly expenses. After two years, inconsistencies triggered regulatory review. The company incurred back taxes, penalties, rushed accounting cleanup, and advisory costs — totaling nearly five times the cost of proper monthly accounting support.

Scenario 2: The Expanding Retail Business — A retail company failed to update its SEC filings and delayed the submission of financial statements. When applying for bank financing to open additional branches, loan approval was delayed due to compliance deficiencies, which in turn delayed expansion and eroded market share.

Scenario 3: The Family-Owned Enterprise — Payroll tax miscalculations accumulated quietly over several years. When discovered, the business faced assessments, penalties, and operational disruption while records were reconstructed.

In each case, direct penalties were only the beginning — the hidden costs proved far more damaging and harder to recover.

Why Proactive Compliance Delivers Long-Term Value

Professional accounting, advisory, auditing, and other corporate compliance services do more than keep filings and regulatory obligations on schedule; they serve as a preventive control system to keep businesses on track.

- Early Risk Identification – potential problems are detected before they escalate into compounding penalties, audits, and other regulatory reviews.

- Accurate Financial Information — reliable financial data improves budgeting, pricing decisions, tax planning, and investment readiness.

- Stronger Internal Controls — with clear documentation and standardized processes, errors are reduced, and the exposure to fraud is minimized.

- Regulatory Preparedness — businesses are not afraid of compliance checks. They are ready for audits, inspections, due diligence, and regulatory reviews.

- Scalable Growth Support — clear records and updated permits or documentation enable smoother expansion, partnerships, and negotiations. Business expansion will be easier and will create many opportunities.

It is also beneficial for a business owner to have peace of mind when operating their establishment, rather than merely hoping they will not be subjected to regulatory scrutiny.

Reframing Compliance: From Expense to Business Protection

Every business invests in insurance, security, equipment maintenance, and employee safety; they do so not because problems are guaranteed to happen, but because risk prevention is a more financially prudent move than responding to issues as they arise.

Compliance works the same way — a single penalty assessment can quickly exceed a full year of professional advisory fees. More importantly, proactive compliance ensures business continuity, credibility, and focus on leadership.

At Babylon2k, we provide integrated accounting, compliance, and advisory services that help businesses operate confidently in an increasingly regulated environment. Our services include:

- Accounting and Auditing

- Tax compliance, filings, and reporting

- SEC regulatory submissions and monitoring

- Compliance health checks and remediation

- Business advisory, financial analysis, and process optimization

👉 Book a consultation with us today, and together, let us start building a compliant, credible, and growth-ready business with expert advisory and accounting support.