Preparedness Meets Compliance

With the recent events the Philippines has faced — floods, frequent earthquakes, and volcanic eruptions, it underscores the importance of being prepared for such disasters. Hence, “Go-bags” are highly encouraged for households, survival kits containing food, water, supplies, and other essentials in case of an emergency.

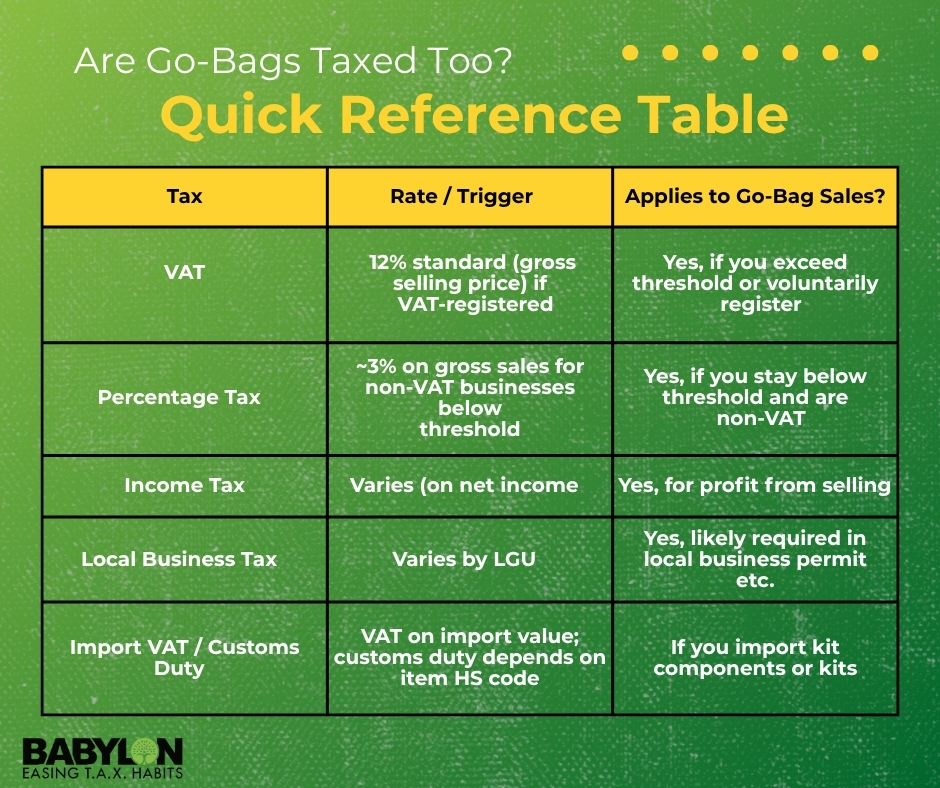

Yet, beyond the importance of preparedness, a question arises in taxation: how are go-bag sales treated under Philippine tax law?

Subject to Value-Added Tax (VAT)

Under Section 106(A) of the National Internal Revenue Code (NIRC), as amended, it is widely known that most sales of goods and services in the Philippines are subject to 12% VAT.

If a business earns annual gross sales or receipts that exceed ₱3,000,000, they are required to register as a VAT taxpayer, issue VAT invoices, and file VAT returns accordingly, as mandated by the BIR. Additionally, Voluntary VAT registration is also allowed for businesses below the threshold that wish to claim input tax credits.

Likewise, for sellers of go-bag kits, this means that each sale of a kit or its components is generally subject to VAT, unless specific exemptions apply (such as sales of certain medicines or medical supplies under Section 109 of the NIRC).

Percentage Tax for Non-VAT Businesses

On the other hand, if a business earns annual gross sales or receipts of ₱3,000,000 or less and has not registered as a VAT taxpayer, the company typically falls under the percentage tax regime.

This requires payment of 3% on gross sales or receipts per quarter, a more straightforward approach that does not involve tracking input VAT. However, once the ₱3,000,000 threshold is exceeded, VAT registration becomes compulsory.

Income Tax Obligations

Indeed, income from the sale of go-bag kits is part of a business’s taxable income. Therefore:

- Corporations are subject to a 25% corporate income tax (CIT), or 20% if their net taxable income does not exceed ₱5 million and total assets are ₱100 million or less (excluding land).

- Individuals and Sole Proprietors are taxed under the graduated income tax rates (0%–35%), or they may opt for an 8% tax on gross sales exceeding ₱250,000, instead of both the graduated rates and percentage tax.

Proper bookkeeping, cost documentation, and accurate tax filings ensure compliance and avoid unnecessary penalties.

Local Business Taxes and Permits

In addition to national taxes, local government units (LGUs) may impose local business taxes and regulatory fees under Section 143 of the Local Government Code of 1991 (RA 7160).

Therefore, these are typically computed based on gross receipts, location, and business classification (e.g., retail, manufacturing, or importation). Sellers of go-bag kits must secure the appropriate business permits to operate legally within their business locale.

Importation and Other Special Considerations

For businesses importing go-bag components, such as first-aid kits or protective gear, customs duties and a 12% VAT apply based on the declared customs value and Harmonized System (HS) code classification.

While some items (such as medicines for tuberculosis, mental illness, or kidney diseases) may be VAT-exempt, the go-bag kit as a whole does not automatically qualify for exemption. Sellers must carefully evaluate each component’s tax treatment to avoid compliance issues.

In Summation

This article is based on UHYMAC 2025-007 Tax Advisory (October 27, 2025) by Kyle Clarence L. Williams and Chriztel Joy Manansala of the UHY Tax Department.

For businesses seeking expert guidance in tax compliance, audit, accounting, and business registration, check our services at Babylon2k.org — your digital gateway to more innovative business solutions.

Powered by #BethAI, Babylon2k’s intelligent assistant for tax and accounting automation.