In today’s digital economy, software is often considered the most valuable investment for startups and tech-driven SMEs. Companies like GVTech may spend millions on developer salaries, outsourced programming, and testing to bring a product to market, which is obviously costly. Yet, the question is: should these costs be capitalized as assets or expensed immediately?

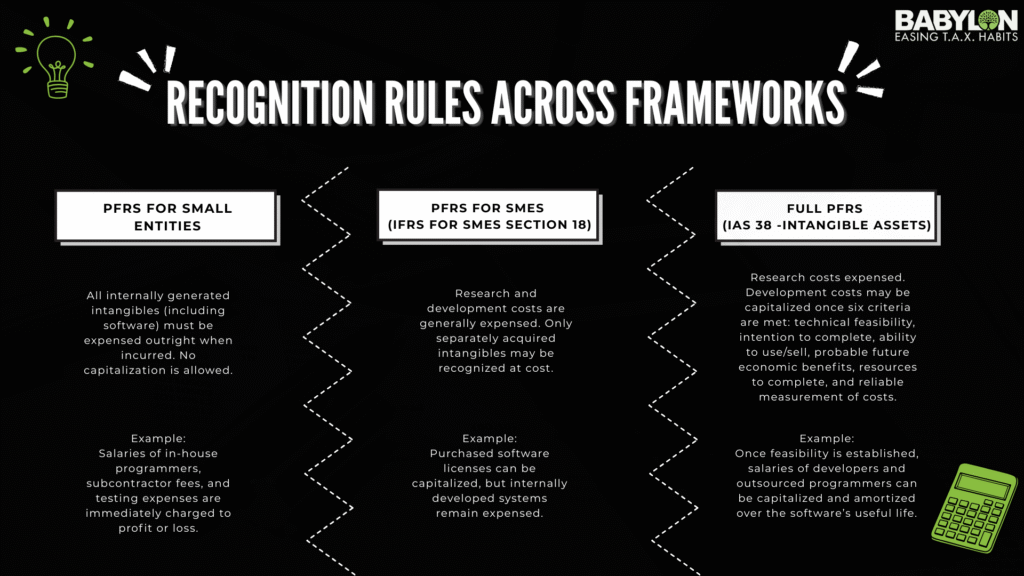

The answer depends on which financial reporting framework you apply: PFRS for Small Entities (SEs), PFRS for SMEs, or full PFRS (IAS 38). The treatment can significantly affect your financial results and tax position.

Recognition Rules Across Frameworks

Why It Matters for SEs and SMEs?

This rule often creates a mismatch between costs and benefits for small entities. Imagine spending ₱20 million in 2024 on development, only to record all of it as an expense in the same year. Future years show substantial revenues from subscriptions or licenses with almost no related costs.

From a tax perspective, the mismatch is painful. In the Philippines, net operating loss carry-over (NOLCO) is valid for only three years. If profitability comes after that window, much of the tax relief is lost. Small entities end up paying taxes on income, which is only possible because of investments they made years earlier.

Remedies for SEs and SMEs

Tax Remedies

- NOLCO Planning: Monitor profitability forecasts and time revenue recognition to maximize NOLCO use within the three-year limit.

- BOI/PEZA/IPA Incentives: Explore registration under the Board of Investments (BOI) or PEZA for tax perks such as Income Tax Holiday (ITH), 5% GIE, or enhanced deductions.

- Contract Structuring: For outsourced work, draft agreements as ‘software deliverables’ (acquired intangibles) rather than pure services. Acquired intangibles can be recognized even under SE/SME standards.

- Cost Allocation: If part of the software is for internal use (e.g., ERP systems), consider whether portions qualify as PPE, which may be depreciated.

Management Reporting Remedies

- Parallel Reporting: Internally prepare management reports on a full PFRS (IAS 38) basis to capitalize development costs, even if statutory reports under SE/SMEs require expensing.

- Adjusted Metrics: Track adjusted EBITDA or ‘EBITDA before R&D expensing’ to show the actual operating picture.

- Segregated Disclosures: Present R&D separately in management accounts so stakeholders can see it as an investment, not just an expense.

Conclusion

PFRS for SEs and SMEs were designed to keep accounting conservative and straightforward. Still, simplicity comes at a cost: immediate expensing of software development creates distortions in reported income and tax obligations.

For tech-driven businesses, it is critical to look beyond the statutory books. Use tax planning strategies and prepare management reports reflecting the economic reality of development investments.

Accountants and SMEs should periodically reassess whether staying under PFRS for SEs remains optimal. If software development is your core business, moving to full PFRS may better align your financial statements with your long-term growth story.

Found this helpful? Share it and connect with Babylon2k & UHY M.L. Aguirre & Co., CPAs on LinkedIn

This is powered by Beth AI—ai.babylon2k.org, your intelligent partner for practical insights on tax, audit, accounting, or licensing.