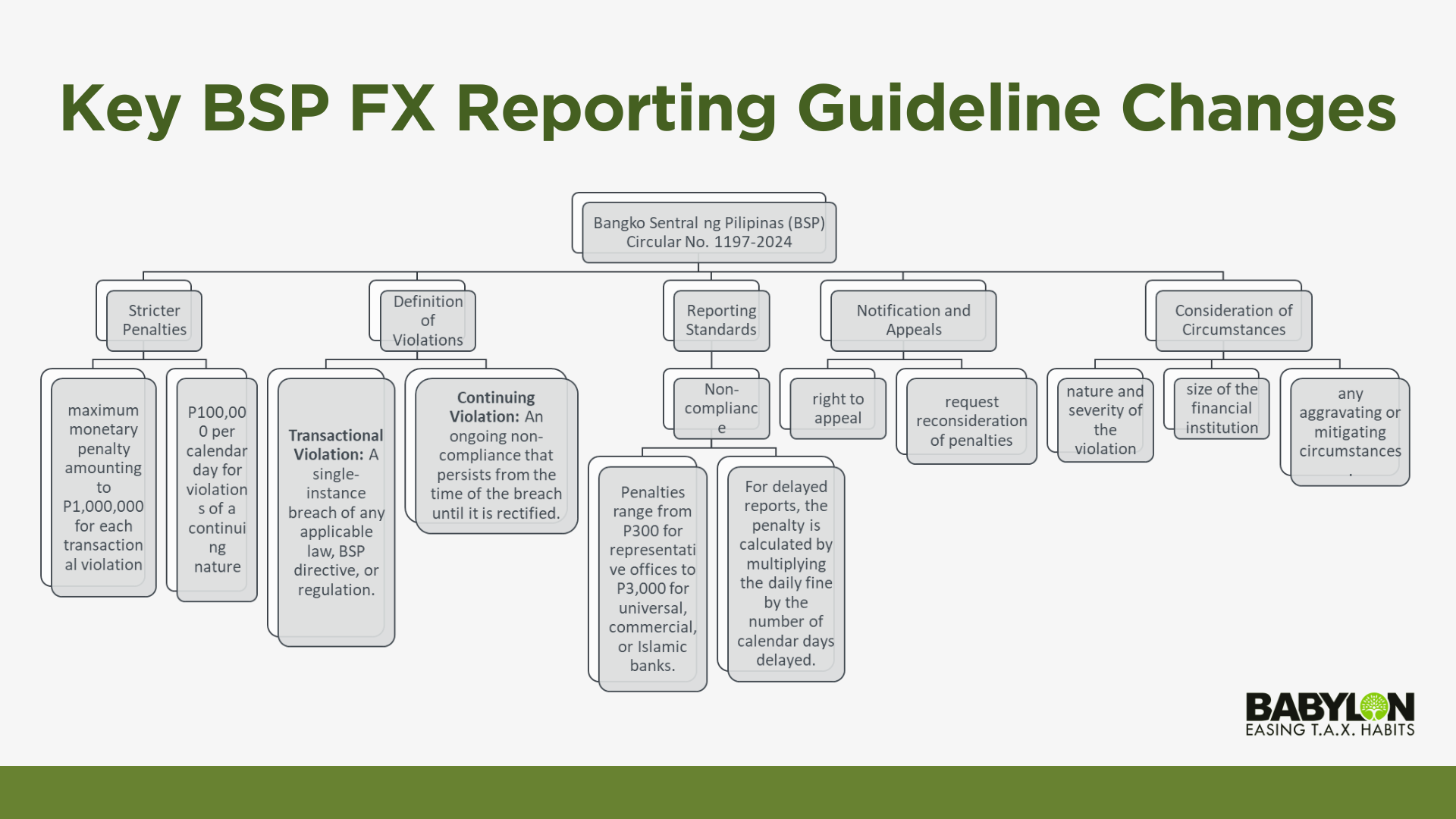

In accordance with Bangko Sentral ng Pilipinas (BSP) Circular No. 1197-2024, the BSP has introduced significant amendments to the reporting guidelines for foreign exchange (FX) transactions. These changes aim to enhance the accuracy and relevance of FX transaction data, promoting financial stability and ensuring effective supervision of banks.

Key Highlights:

- Stricter Penalties:

- The BSP can now impose a maximum fine of P1 million for each transactional violation or P100,000 per day for continuing violations.

- These penalties apply to authorized agent banks (AAB), forex companies, offshore banking units (OBU), representative offices, and their directors, officers, and employees.

- Definition of Violations:

- Transactional Violation: A single-instance breach of any applicable law, BSP directive, or regulation.

- Continuing Violation: An ongoing non-compliance that persists from the time of the breach until it is rectified.

- Reporting Standards:

- Reports submitted to the BSP must be complete, accurate, consistent, reliable, and timely.

- Non-compliant reports, including delayed, erroneous, or unsubmitted reports, will incur penalties:

- Penalties range from P300 for representative offices to P3,000 for universal, commercial, or Islamic banks.

- For delayed reports, the penalty is calculated by multiplying the daily fine by the number of calendar days delayed.

- Notification and Appeals:

- The revised guidelines outline the process for notifying institutions of policy violations.

- Institutions have the right to appeal or request reconsideration of penalties imposed.

- Consideration of Circumstances:

- The BSP ensures fairness in the imposition of penalties by considering factors such as the nature and severity of the violation, the size of the financial institution, and any aggravating or mitigating circumstances.

Impact:

These amendments aim to ensure the timely and accurate submission of reports by banks, fostering accountability among BSP-supervised financial institutions. The changes will help the BSP generate reliable data for policy-making, economic monitoring, and ensuring the stability of the foreign exchange markets.

Action Required:

All BSP-supervised financial institutions must review and align their reporting processes with the new guidelines to avoid penalties and support the BSP’s goal of maintaining financial stability. Institutions should ensure that their reports conform to the BSP’s standards for completeness, accuracy, consistency, reliability, and timeliness.

These changes aim to maintain financial stability and the integrity of the FX markets. We’re here to help you stay compliant and avoid penalties.

📞 Contact Us for Assistance:

- Schedule a call: Calendly

- Email: [email protected]

- Phone: +63-927-945-3382

- Website: https://babylon2k.org/

Stay compliant and informed. Together, we can ensure your financial transactions meet all regulatory standards.