Cryptocurrency has grown into a global phenomenon, with over 560 million users worldwide. In the Philippines, more and more people are exploring crypto as an alternative investment, drawn by its accessibility and potential for high returns.

If you’re new to digital assets, it can be confusing to know where to start. This guide breaks down how to invest in cryptocurrency in the Philippines, from choosing platforms to understanding risks.

Is Cryptocurrency Legal in the Philippines?

Yes, cryptocurrency is permitted in the Philippines and regulated under frameworks established by local authorities.

In 2017, the Bangko Sentral ng Pilipinas (BSP) released Circular No. 944 also known officially as Virtual Currency Exchanges (VCEs). This created the legal rules for cryptocurrency exchanges. It requires all exchanges to register with the BSP and follow anti-money laundering (AML) policies to make transactions safer.

The Securities and Exchange Commission (SEC) also plays a role in crypto regulation, particularly in overseeing activities like Initial Coin Offerings (ICOs) and securities trading within the crypto sector.

This joint regulatory approach ensures that while crypto is accessible, it operates within set legal and financial boundaries.

Why Do People Invest in Cryptocurrency?

Cryptocurrency attracts investors in the Philippines for its potential high returns, but there are additional reasons behind its rising popularity.

High Potential Returns

Many investors are drawn to cryptocurrency because of the possibility of significant returns. Major cryptocurrencies like Bitcoin and Ethereum have demonstrated impressive growth, with Bitcoin’s price increasing by an average of 72% in 2023 alone.

This kind of return is hard to find in traditional investments, making crypto a high-yield option for those willing to accept its volatility.

While the risk level is high, some investors view it as worth the chance for substantial gains. This potential for high returns has made crypto particularly appealing to younger investors looking for growth opportunities.

Accessibility

Crypto investment is more accessible than many traditional assets. All that’s needed to start is an internet connection and a minimal initial deposit, making it possible for people from all walks of life to invest.

For individuals without bank accounts, crypto offers an entry into the financial world and opens up opportunities for wealth-building that weren’t previously available.

Security

Cryptocurrencies are highly secure due to their unique access system. Only the person who holds the private key to a crypto wallet can access its funds. For Bitcoin, this private key is a complex 256-bit number, essentially a string of 256 binary digits (0s and 1s).

Moreover, each transaction is validated across a distributed network, which makes altering the blockchain extremely difficult.

To tamper with the blockchain, a hacker would need enough computing power to alter multiple blocks faster than the network can verify them. This is a nearly impossible task due to the expense and complexity involved.

Transparency

A key advantage of cryptocurrency is its transparency. Every transaction is recorded on a public blockchain ledger, allowing anyone to access and verify transaction details without needing special permissions.

Tools like Etherscan for Ethereum and Blockchain Explorer for Bitcoin make it easy to search for specific transactions or addresses which give users direct insights into the flow of funds.

This open access fosters trust and accountability within the crypto community, as all data remains verifiable and tamper-proof.

Inflation Protection

Cryptocurrencies are often seen as hedges against inflation, as their supply is limited. For example, only 21 million Bitcoin will ever be created. The finite supply means that as demand for these digital assets grows, their value typically rises. This contrasts sharply with traditional currencies that can be printed at will, reducing their value.

For investors worried about currency devaluation and rising inflation, crypto offers a way to store value in an asset that doesn’t erode as quickly over time. This limited supply gives it an appeal for Filipino investors looking to protect their savings from inflationary pressures in the peso and other fiat currencies.

Decentralization

Many investors appreciate that cryptocurrency operates outside the traditional banking structure. This means that transactions don’t require intermediaries like banks, offering a sense of independence from centralized control.

In places where trust in banks is low or where financial policies can heavily influence savings, decentralization offers an appealing alternative.

Diversification

Cryptocurrency provides a way to diversify portfolios beyond conventional assets like stocks, bonds, and real estate.

Diversification is crucial because it helps balance out risk. When one type of asset underperforms, others may perform better, stabilizing the overall portfolio.

Crypto’s unique characteristics make it less correlated with traditional financial markets, offering a potential hedge against stock market downturns. By including crypto, investors in the Philippines can spread risk across different assets, enhancing their portfolio’s resilience during economic uncertainties.

For Filipino investors, crypto represents a way to manage finances without relying on institutions that might impose fees, control access, or be susceptible to economic instability.

How to Start a Cryptocurrency Investment in the Philippines

Starting a crypto investment can feel overwhelming, but breaking it down into steps makes it more manageable.

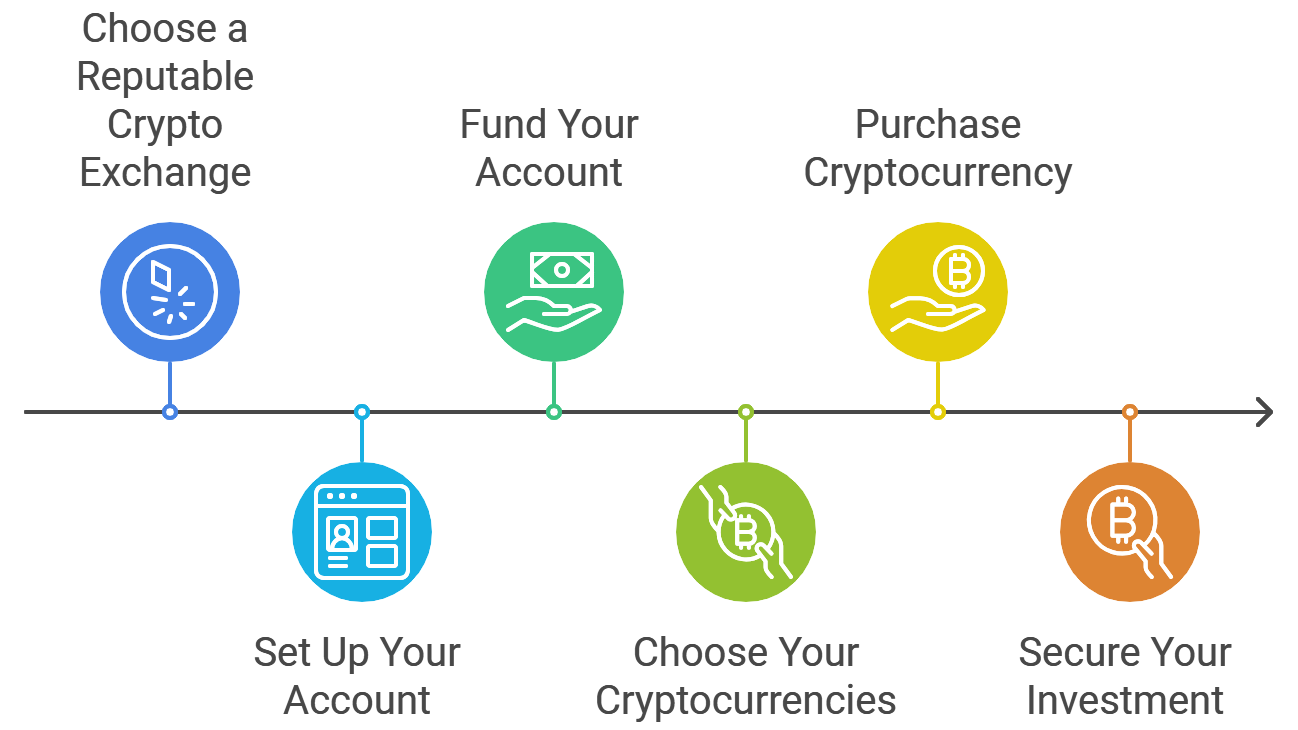

Steps to Start Cryptocurrency Investment in the Philippines

Step 1: Choose a Reputable Crypto Exchange

To invest in crypto, you’ll need a registered platform. Look for one approved by BSP for a secure and reliable investment experience. Some popular choices include Binance, Coins.ph, and PDAX.

Step 2: Set Up Your Account

After selecting an exchange, create an account and complete the KYC (Know Your Customer) verification. This usually involves submitting an ID and proof of address to comply with Philippine regulations.

Step 3: Fund Your Account

Deposit funds into your account. You can do this by transferring pesos from your bank account or using other payment methods offered by the exchange. Some platforms accept GCash or PayMaya for added convenience.

Step 4: Choose Your Cryptocurrencies

Different cryptocurrencies have different levels of risk and growth potential. Research your options, focusing on popular coins with established track records.

Step 5: Purchase Cryptocurrency

Decide how much you want to invest, then make your first purchase. Most platforms allow you to buy in peso increments, so you don’t have to buy a whole coin. Once purchased, your crypto will appear in your account wallet.

Step 6: Secure Your Investment

Store your crypto in a secure wallet. Exchanges typically offer wallet services, but a hardware wallet is a safer, offline option if you’re investing a significant amount.

Popular Cryptocurrencies You Can Invest In

Some of the most popular cryptocurrencies for Filipinos include:

- Bitcoin (BTC): The original cryptocurrency, known for its high value and strong security.

- Ethereum (ETH): Offers smart contracts and decentralized applications.

- Cardano (ADA): Known for a focus on sustainability and scalability.

- Ripple (XRP): Offers quick transactions, often used for international payments.

- Solana (SOL): Popular for its low transaction fees and scalability.

Each of these has unique features and serves different purposes within the crypto ecosystem.

Best Crypto Trading Platforms and Exchanges in the Philippines

For Filipino investors, using a registered platform provides added security and peace of mind. Here are some top choices:

- Coins.ph: A local platform regulated by BSP, suitable for beginners.

- PDAX (Philippine Digital Asset Exchange): BSP-regulated, focused on peso trading pairs.

- Binance: Global exchange with extensive coin offerings and advanced features.

- Crypto.com: Provides a user-friendly mobile experience with staking options.

- eToro: Known for its social trading, where beginners can mirror the investments of experienced traders.

Each platform has its pros and cons, so choose one that aligns with your needs, such as ease of use, fees, and supported coins.

Key Considerations Before Investing in Cryptocurrency

Investing in crypto presents unique risks and factors to think about. Here are some key points:

Risk Management

Cryptocurrency prices are notoriously volatile, often experiencing sudden and significant shifts. To manage your risk, only invest what you’re prepared to lose and avoid overexposing your portfolio to a single asset. Balancing crypto with more stable investments can help cushion against downturns in the market.

Security

Your crypto assets are only as safe as your wallet security measures. Use wallets with strong encryption, such as hardware wallets, and enable two-factor authentication (2FA) to reduce the risk of unauthorized access. Keeping private keys and passwords confidential is essential, as losing them means losing access to your funds.

Regulatory Updates

The regulatory landscape around crypto is constantly changing, especially as governments refine their approach to digital assets. In the Philippines, new laws could emerge that affect your rights to trade or the taxes owed on gains. Staying informed helps you make decisions that align with current regulations and avoid unexpected issues.

Tax Implications

Crypto earnings in the Philippines are subjected to digital tax. Therefore, crypto traders are required to carefully report their gains and income. Consulting a tax professional familiar with digital assets can provide clarity on your obligations and help you stay compliant. Proper tax planning helps prevent unexpected liabilities and ensures a smoother investment experience.

Crypto Investment FAQs

How many crypto owners are in the Philippines?

Estimates suggest that nearly 7 million Filipinos are involved in crypto. This growing interest is driven by young, tech-savvy Filipinos seeking investment alternatives.

How do I know when to buy and sell my crypto?

Timing the market is challenging, especially with crypto’s volatility. Use technical analysis, set price alerts, and avoid emotional trading. For long-term growth, consider a dollar-cost averaging (DCA) strategy, where you invest fixed amounts over time.

How do taxes work with trading crypto?

Crypto earnings are considered taxable income. If you profit from trading, you need to report this to the Bureau of Internal Revenue (BIR). Capital gains tax or income tax may apply, depending on your income level and trading activity. For detailed guidance, consult with a tax expert.

How do I minimize risks when buying cryptocurrency?

To keep risks low when buying cryptocurrency, spread your investments across multiple assets instead of betting everything on one. Choose trusted platforms with strong security features, like multi-factor authentication, to protect your funds. Finally, stay updated on market movements and new regulations so you can adapt your strategy as needed.

Digital Tax and Crypto Made Simple with Babylon2K’s Consultation Services

Investing in cryptocurrency offers exciting potential but also introduces unique challenges, including understanding digital tax obligations.

Babylon2K provides consultation services designed to help you navigate these complexities, from managing tax responsibilities to making secure investment choices. With professional insights, you’ll be better prepared to handle digital taxes and make informed decisions that align with your financial goals.

Request a quote today and begin your crypto journey confidently with Babylon2K.

For more inquiries, message our AI chatbot, email us at [email protected], or contact us via Viber/WhatsApp at +63-927-945-3382.