When a company receives an interest-free advance from a related party, an accounting question arises: can the borrower capitalize any borrowing cost related to that advance?

Under the accounting standards, specifically PAS 23 – only borrowing costs actually incurred by the entity can be capitalized as part of a qualifying asset. In other words, unless your company bears the borrowing expense itself, it cannot recognize any capitalization for that cost.

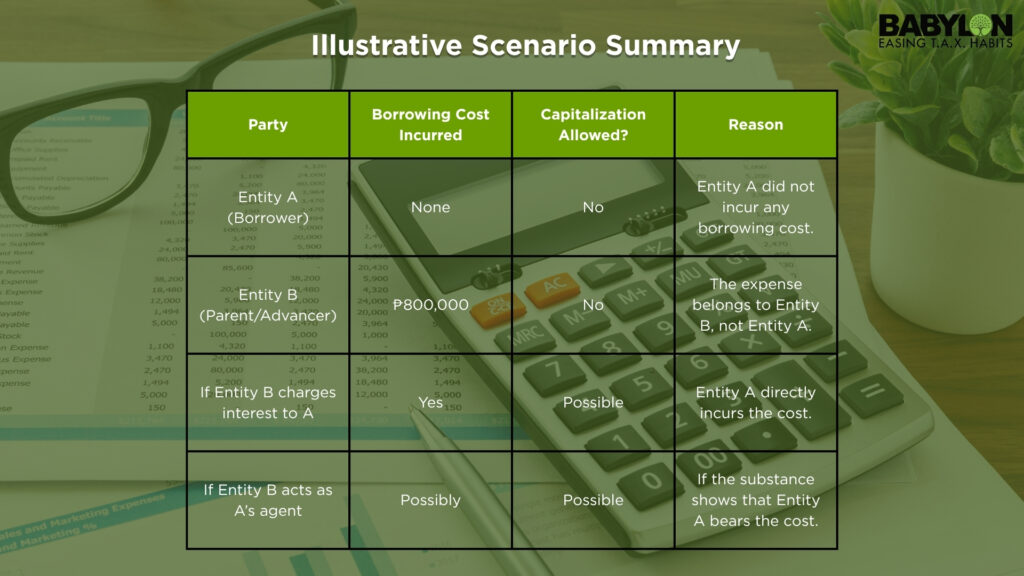

Illustrative Scenario

To better understand the subject matter at hand, let’s put up a scenario for this:

Entity A receives an interest-free advance of ₱10 million from its parent company, Entity B.

To fund this, Entity B takes out a ₱10 million loan from a bank at 8% interest, resulting in ₱800,000 in annual interest expense.

Technical Analysis

- The reporting entity must directly incur borrowing costs.

- Interest-free advances from related parties do not create borrowing costs.

- Costs borne by another party, even a parent company, cannot be capitalized unless there’s clear evidence that the related party is acting as an agent or on behalf of the borrowing entity.

As stated under PAS 23, “Borrowing costs are interest and other costs incurred by an entity in connection with the borrowing of funds.” Thus, this limits capitalization strictly to expenses borne by the entity itself, not by any related or parent entity.

Key Takeaway

Unless the related party acts as your company’s agent and you can prove it through “substance over form”, you cannot capitalize interest expenses that another entity pays.

Likewise, the rule is simple: no direct borrowing cost, no capitalization.

Why This Matters for Your Business

Misinterpreting PAS 23 can lead to incorrect asset valuation and compliance risks during audit or BIR inspection of books. Proper accounting treatment protects your books and credibility, especially in group or intercompany setups.

Need Help Reviewing Complex Transactions?

At Babylon2k, we help businesses navigate complex accounting standards like PAS 23, ensuring your financial statements remain compliant, defensible, and audit-ready.

This article is based on insights shared by Mr. Taimur Haider, Audit Manager at UHYMAC, reflecting best accounting practices aligned with Philippine Accounting Standards.

Talk to our accounting experts today to streamline your financial reporting and ensure your capitalization policies align with Philippine standards.