Many people still wonder: “What if I cannot pay my debt for a long time?” “Would I be imprisoned if I admitted that I don’t have the means to pay?” or “Could my creditor file a criminal case if I am insolvent?”

Let’s break down what the law really says about these situations and understand when unpaid debts remain a civil liability and when it actually becomes a criminal one.

The General Rule is under our Constitution

As provided for in the 1987 Philippine Constitution, non-payment of debt is not a crime in itself. This can be seen explicitly in Article III, Section 20 which states: “No person shall be imprisoned for debt or non-payment of a poll tax.” This was based on local and international policies that non-payment of debt is a civil liability in nature and does not equate to committing a crime.

In simpler terms, this means that if a debtor merely fails to pay, whether on time or not in full, the consequence is civil liability (i.e., collection case), not imprisonment. However, the huge question is: “Is there a case that can involve imprisonment?” — Of course, there is always an exception to every general rule, and that is when checks and fraudulent acts enter the picture, the line shifts into the phase of criminal law.

How can Checks lead to Imprisonment?

Checks can be used to settle debts incurred by a person or an establishment for as long as the parties agree. Likewise, the term “Bouncing Checks” has been widespread ever since. It is an act whereby a person or a commercial entity issues a check to its creditor. Whenever the creditor goes into a bank and translates it for cash, the issuer does not have enough balance in his bank to fulfill his obligation to the creditor, which gives rise to criminal liability.

Bouncing Checks are governed by Batas Pambansa Blg. 22, also known as the “Anti-Bouncing Checks Law,” wherein it states in Section 1 that:

“Any person who makes or draws and issues any check to apply on account or for value, knowing at the time of issue that he does not have sufficient funds in or credit with the drawee bank for the payment of such check in full upon its presentment,… shall be punished by imprisonment of not less than thirty days but not more than one (1) year or by a fine of not less than but not more than double the amount of the check which fine shall in no case exceed Two Hundred Thousand Pesos, or both such fine and imprisonment at the discretion of the court.”

Hence, the key instance here is the debtor’s issuance of a worthless check. The law protects the banking system and commercial transactions, not necessarily to punish unpaid debt but to comply with settlement agreements in good faith. Additionally, even if the drawer honestly intended to pay later, issuing a bad check is punishable, and the criminal liability will depend on how many checks were bounced.

Fraud Effect on Debts

Another critical provision to consider regarding Debt is under our country’s Criminal Code, specifically Article 315, which pertains to Swindling, commonly known as Estafa. By definition, it is committed by any person who intends to defraud another through abuse of confidence or deceit, causing damage in essence.

The General Elements for Estafa are:

- There must be a false pretense, a fraud, or an abuse of confidence

- The offender committed the act with the intent to defraud

- The offended party suffered damage or has been prejudiced with pecuniary estimation.

Simply stated, Estafa occurs when someone tricks or abuses another’s trust to gain money or property, with a dishonest intent to cheat and cause financial loss. That’s why incurring debt must be accompanied by complete honesty and accountability so that it does not cross the line that could lead to imprisonment. Further, the following are the length of prison times depending on the amount involved in a case:

- If the amount is less than or equal to ₱40,000: From 2 months and 1 day up to 6 months

- If the amount is greater than ₱40,000 but less than or equal to ₱1,200,000: From 4 months and 1 day up to 2 years and 4 months

- If the amount is greater than ₱1,200,000 but less than or equal to ₱2,400,000: From 2 years, 4 months and 1 day up to 8 years

- If the amount is greater than ₱2,400,000 but less than or equal to ₱4,400,000: From 8 years and 1 day up to 14 years and 8 months

- If the amount exceeds ₱4,400,000: From 14 years, 8 months and 1 day up to 20 years, plus 1 year for every additional ₱2,000,000, capped at a maximum of 20 years

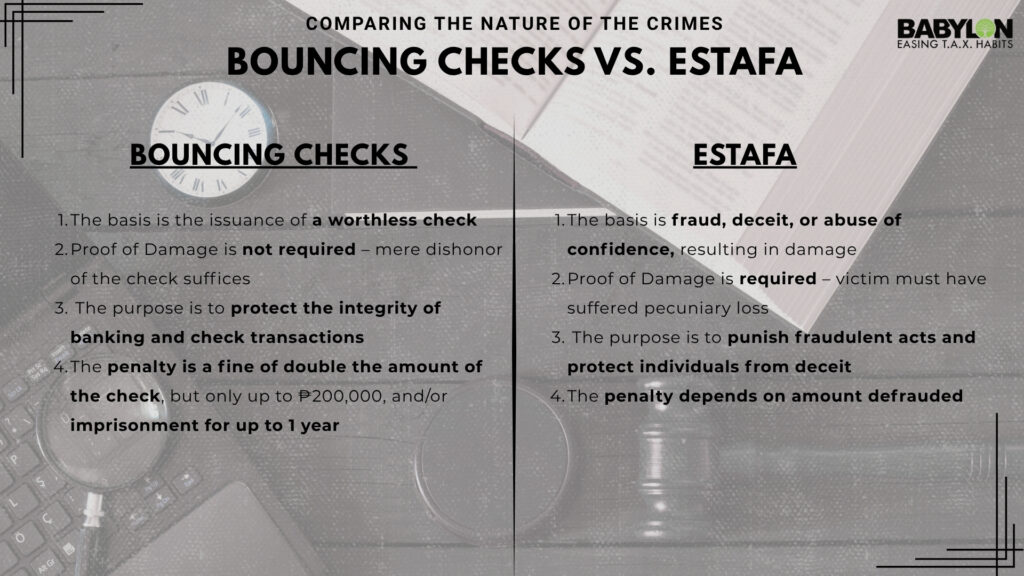

Comparing Bouncing Checks & Estafa

Can You be Liable for both Crimes?

The answer is yes. According to the Supreme Court, a single act of issuing a bouncing check can give rise to both violations of Estafa and BP 22, because they punish different wrongdoings:

- BP 22 = the issuance of the worthless check itself

- Estafa = the implication of deceit and the resulting damage to the victim.

A case to cite is Lozano v. Martinez, G.R. No. L-63419 (1986). The Court explained that BP 22 was enacted to discourage the issuing of bouncing checks as a matter of public welfare and is indeed separate from Estafa, which punishes deceit. Hence, one may be prosecuted for both without violating the rule against double jeopardy.

The Bottom Line

The 1987 Constitution assures that debt is not criminal in nature but rather a civil obligation. Issuing worthless checks and using them to defraud others for one’s benefit carries the burden of criminal consequences under BP 22 and Estafa.

At Babylon2k, we believe financial literacy is more than awareness – it’s empowerment. Learn your rights, make smarter financial steps and build a better future.

Follow us for more practical insights and expert guidance.

(Disclaimer: Content developed with support and insights from our in-house counsel.)