When to file a VAT Refund?

Description: Under Philippine law, goods and services are subject to a 12% VAT. Taxpayers may reclaim their money with VAT refund, but only in certain conditions. Keywords: value-added tax, zero-rated sales, VAT refund, VAT credit, VAT philippines, tax philippines Out of the multiple tax types out there, one of the major tax burdens is the value-added tax […]

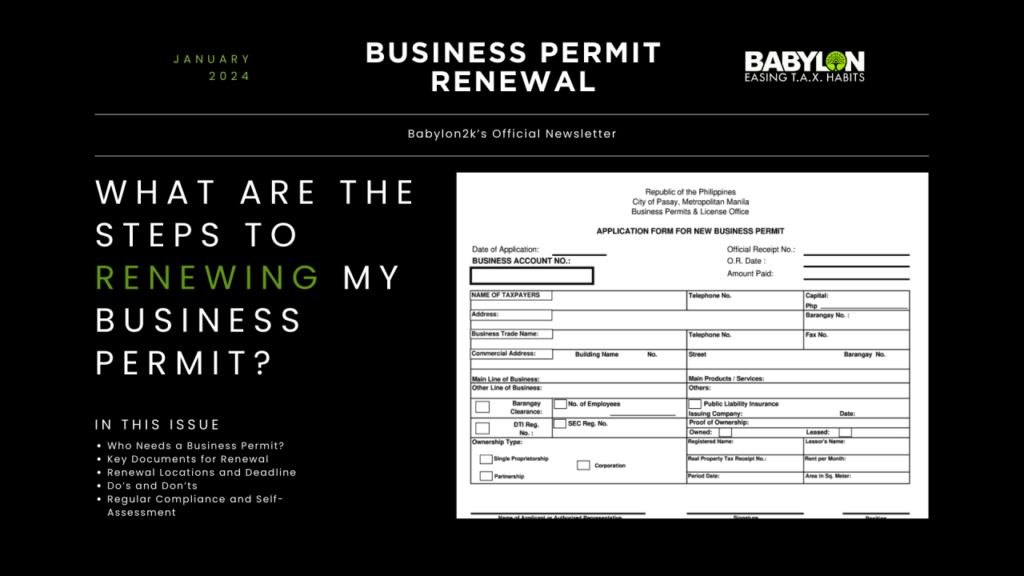

The Dos and Don’ts when Renewing Your Business Permit

Discover how Babylon2K is transforming the accounting and financial landscape in the Philippines with its innovative ‘doing business’ concept and commitment to saving time, reducing costs, and minimizing risks for businesses and professionals across the country.

Top 10 Things You Should Know About the Ease of Paying Taxes Act

A 11976, the Ease of Paying Taxes Act, marks a transformative change in the Philippine tax system. It aims to create a more equitable and efficient tax environment, focusing on modernization, taxpayer rights, and ease of compliance, particularly for SMEs.

BIR Increases VAT Exemption Threshold for Residential Property Sales

This advisory informs the public, particularly real estate developers, investors, and homebuyers, about the Bureau of Internal Revenue (BIR)’s recent increase in the value-added tax (VAT) exemption threshold for residential property sales.