You’ve probably seen it before — a tempting little button that says “Pay in installments with SPaylater, Check out with TikTokPaylater, or Use LazPaylater”. Just one click, and that gadget, those shoes, or that “I deserve” this thing you want is yours instantly. It sounds empowering, right? There’s no need to wait for your next salary or to have a credit card.

But here’s the real question: Is Buy Now, Pay Later (BNPL) helping Filipinos achieve financial freedom or is it a cleverly disguised debt-trap in modern times?

Let’s unpack this modern-day spending habit.

What is Buy Now, Pay Later?

The Buy Now, Pay Later scheme is a type of short-term financing that lets you purchase items immediately and split payments into smaller installments, often offering interest-free on particular “Payday Sale” or “Date Sale (10.10 or 11.11). In contrast with credit cards, BNPL applications do not always require detailed credit checks as approval is often instant, and repayment terms can range from a few weeks to several months.

In the Philippines, platforms like SPaylater, LazPaylater, and TikTokPaylater have become popular because they are integrated with major e-commerce platforms such as Shopee, Lazada, and TikTok Shops, making it much easier to shop now and pay later.

The trend of BNPL in the country is indeed no surprise, as many Filipinos do not own credit cards. BNPL offers a flexible, digital alternative for online shopping, particularly for students, freelancers, and small business owners.

Inevitable Promise of Empowerment and Convenience

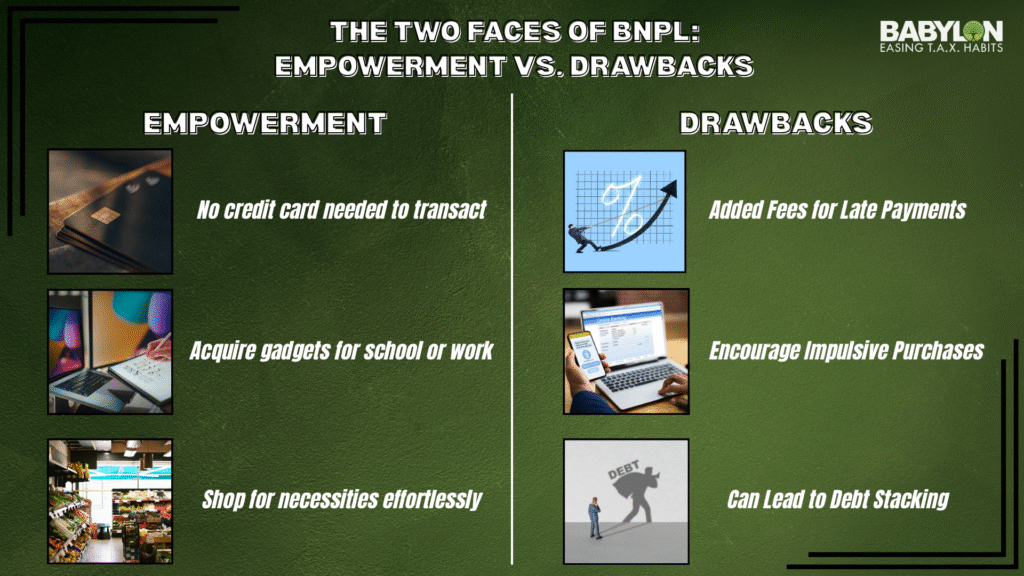

At first view, BNPL feels so empowering. It bridges financial gaps by providing control over your spending, allowing you to get what you need or want now without stressing about a huge, upfront expense.

The level of convenience creates a great sense of financial empowerment, providing fast, flexible, and often 0% payment options in every purchase. BNPL also promotes inclusion by allowing more Filipinos to engage in digital commerce without the hassle of traditional banking issues.

The Drawback of Convenience: Turning to a Crushing Debt

Here’s where things get tricky – What starts as a harmless P499 purchase can turn into a pile of “small” paylater bills, overdue reminders, late fees, and high interest rates.

BNPL may appear safe and very convenient, but many users overlook the most significant risks:

- High Interest & Hidden Fees: While often advertised as “0% interest,” missing a single payment can trigger hassling late fees and processing charges that quickly pile up your debt.

- Encouraging Impulsive Buying: BNPL makes it dangerously easy to buy things you don’t need and can’t truly afford, leading to overspending.

- Debt Stacking: It’s easy to lose track when you’re juggling payments for SPayLater, LazPayLater, and TikTok PayLater simultaneously. This is a fast way to a personal debt trap.

- The Psychological Impact: Because the money doesn’t leave your account immediately, it feels like “invisible debt.” This makes it harder to feel the real financial impact until the bills come due, contributing to rising consumer debt in the Philippines.

How to Utilize BNPL Wisely

If you are using SPaylater, LazPaylater, or TikTokPaylater, discipline is the key. Authentic financial literacy is about using these platforms to your advantage while not letting them control you.

- Golden Rule: Only use BNPL for purchases you can afford to buy with cash right now, and, for essentials, not based on impulsiveness.

- Set Payment Reminders: Fees, Penalties, and Interest could go higher if you are negligent on your dues. Tracking all your obligations is essential to avoid these problems.

- One at a Time: Avoid using BNPLs of multiple platforms, stick only to one to have an easier management of your liabilities

- Read the Interesting Print: understand the processing fees, interest rates, and other important considerations before purchasing an item.

With the proper mindset, BNPL management turns it from a potentially dangerous risk into a strategic financial tool that determines whether it empowers you or sets up a trap for you.

Final Verdict

“Buy Now, Pay Later” gives you power and a mirror — having access to means and reflecting the discipline of the person engaging in it. If used correctly, BNPL can be a trusted financial tool, and if abused, it can quietly turn into a debt trap.

At Babylon2k, financial empowerment starts with awareness. So, the next time you see that “Pay Later” button, do the well-known quote “Think before you click”: because true financial freedom is not about being able to buy more, but rather, it is about understanding the cost behind convenience.