A new assessment by the Organization for Economic Co-operation and Development (OECD) reveals that the Philippines’ Shipbuilding sector has significant potential, yet is being held back by structural challenges.

The recent September 2025 report showcases the industry’s clear advantages while highlighting the need to address such crucial gaps.

Natural Advantage and Real Challenges

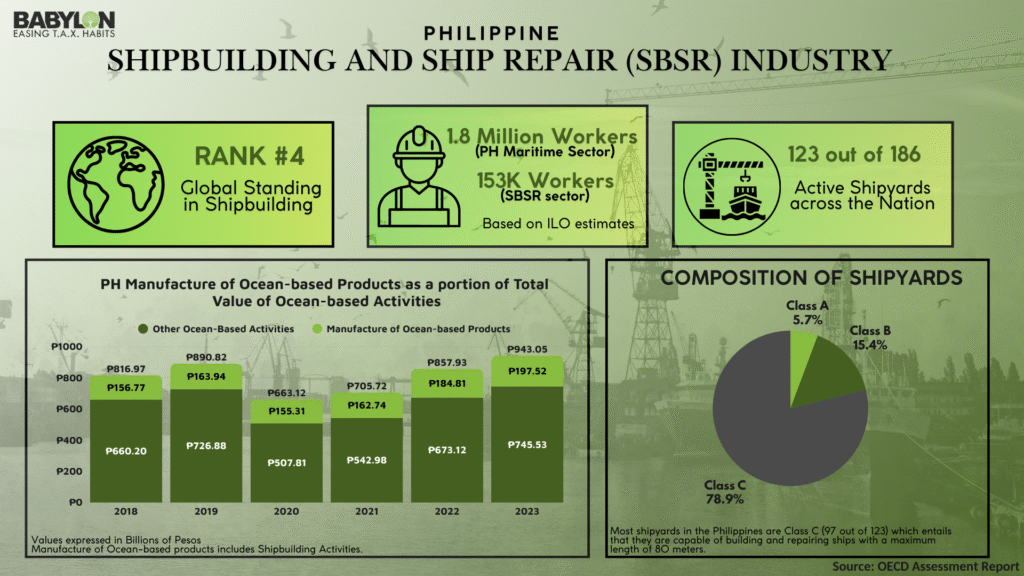

The Philippines has innate advantages for the shipbuilding industry. As a nation composed of thousands of islands, there’s a constant need for boats and ships, while the country’s location in Southeast Asia puts it right in the middle of busy shipping routes. Major international companies such as Seatrium and Tsuneishi have already established operations here in our country, offering investments and expertise. Additionally, the economic impact of this sector is evident in the government-gathered data provided by PSA, which shows the manufacture of ocean-based products as a significant factor, including shipbuilding, contributing ₱197.52 billion in 2023.

The workforce is another positive attribute of the country. Filipino workers have shown their maritime skills at a competent level, with thriving wages compared to other regions and access to training programs spearheaded by international shipyards.

On the other hand, the industry also faces serious issues. Some of these were the usage of outdated equipment by local shipyards, the country’s heavy reliance on imported materials and machinery, and the cost of Filipino-built ships compared to those of other competitors. Additionally, safety standards are inconsistent, and the tendency for brain drain is also at stake due to better-paying jobs abroad.

What’s Working and What is Not?

The Government has created and implemented business-friendly policies to develop and improve the sector, such as allowing full foreign ownership and offering incentives for export-focused companies. The Maritime Industry Development Plan aims to increase the competitiveness of the country’s ship industry and improve the workforce.

However, there is a “no-win situation,” as local shipping companies often prefer buying foreign-made ships because they are considered higher quality, cost-efficient, and timely than those built locally. This preference issue compromises potential industry growth domestically.

Ninety-five percent (95%) of domestic shipyards owned by non-foreigners focus on maintenance and repair activities. The others are stuck doing assembly work for foreign designers rather than executing a whole manufacturing operation, which shows how they are limiting the value they can add and being dependent on overseas partners.

Path towards Improvement

The OECD report suggested the following five areas for key improvements of the industry:

- Enhance Local Supply Chains: Develop domestic manufacturing of ship parts and equipment to reduce dependence on imports and foreign suppliers and generate more wealth locally.

- Upgrade Facilities to Modernize Ones: Renovate deteriorating shipyards and employ modernized equipment and infrastructure to attain global competitiveness.

- Invest in the Workforce: Drastically improve the quality of maritime education, reduce student dropouts, create better incentives to keep skilled workers domestically, and gradually eliminate the impact of brain drain.

- Adopt Green Technology: Changing to environmentally friendly technology to meet international standards and access new market opportunities, focusing on the sustainable shipping industry.

- Coordination with Government Support: Harmonize the different government policies to ensure consistent and clear support for the industry sector.

Looking Ahead

The Philippines has its own favorable aspects and workforce to become a major competitor in the global shipbuilding industry, but turning this potential into reality requires fixing the current issues and addressing the limitations. Success will heavily depend on the industry’s movement, aiming beyond just assembly work and committing to full manufacturing capabilities while building a local supply chain.

With the appropriate policy coordination and investment focus, the country could transform from a low-cost assembly work hub into a competitive shipbuilding state. The OECD reports provide the necessary insight and areas for improvement — it’s now the turn of the Government and the industry itself to implement the mentioned recommendations and unlock the industry’s true potential.

The stakes are high. If done right, the shipbuilding sector can significantly contribute to the Philippine Economy and establish the state as a key player in the global maritime market.

Babylon2k provides a wide range of market intelligence and strategic advisory services for investors and businesses seeking opportunities in the Philippine maritime industry. Our team helps navigate the complexity of shipbuilding investments, from identifying potential investments to understanding regulatory policies and keeping up with key industry competitors. Contact us to learn how the evolving shipbuilding sector could fit into your investment portfolio.

For an in-depth understanding of the details, you may visit the full OECD report, which can be accessed through the following link: