Automated accounting systems are a must for any business looking to streamline financial operations and reduce manual workload. These systems offer a wide range of benefits, from improving accuracy to saving valuable time.

Businesses that fail to adapt risk falling behind their competitors, as automation becomes the new standard in the finance industry.

In this article, we’ll explore the key benefits of automated accounting systems and how you can get started.

What is an Automated Accounting System?

An automated accounting system refers to software that performs accounting tasks with minimal human intervention. These systems can handle everything from transaction recording and invoice generation to reconciliation and reporting, replacing manual data entry and tedious processes with more efficient workflows.

Popular automated accounting software includes tools that integrate with other financial platforms, ensuring seamless data flow and real-time access to financial information.

What is the difference Between Manual and Automated Accounting?

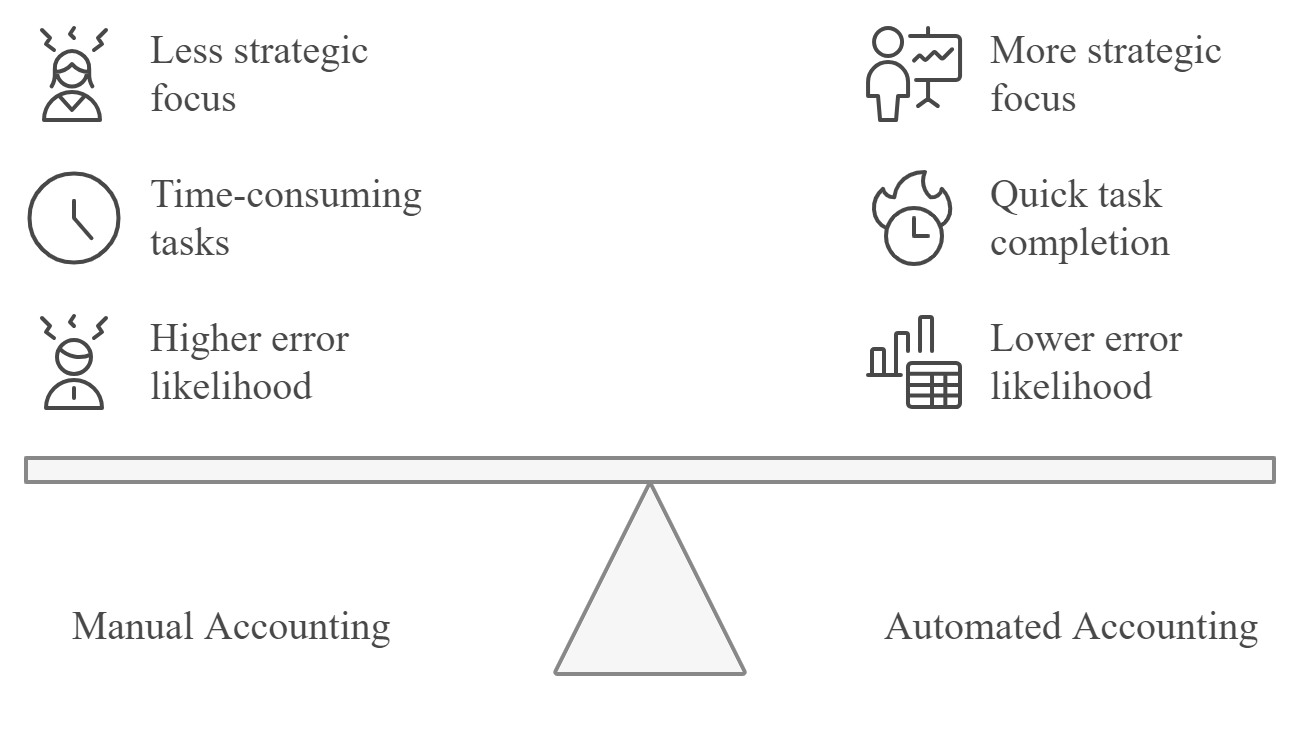

The main distinction between manual and automated accounting is in the handling of data. Manual accounting relies on human input to record and verify transactions, which increases the likelihood of errors and consumes valuable time.

In contrast, automated accounting systems automatically track, process, and report financial data, allowing accountants to focus on analysis and strategic planning.

For instance, tasks that would take days or weeks in a manual setup can now be completed in minutes using an automated system, significantly improving productivity.

Manual vs. Automated Accounting

What are the Benefits of Accounting Automation?

Here are some of the key advantages that businesses typically experience when they make the switch to automated accounting systems:

Time Savings

The most immediate benefit of accounting automation is the time it saves. Instead of spending hours manually entering data, reconciling accounts, or generating financial reports, these tasks are completed in a fraction of the time by the software.

Improved Accuracy

Human errors are common in manual accounting, whether it’s a miskeyed number or a skipped entry. According to a study, automated systems greatly reduce the risk of these errors by up to 90% by ensuring data is processed consistently. This increased accuracy not only helps in day-to-day accounting but also plays a critical role during audits, making automated systems a key component of audit solutions.

Cost Efficiency

Automation can lead to significant cost savings. By streamlining processes and eliminating the need for additional personnel to handle repetitive tasks, companies can reduce overheads. Additionally, the improved accuracy that automation offers means fewer costly errors, such as overpayments or missed billing opportunities.

Real-Time Access and Insights

With cloud-based automated accounting systems, businesses have real-time access to financial data from anywhere. This feature is particularly valuable for outsourced accounting firms that manage multiple clients. Real-time data enables better decision-making and provides businesses with actionable insights into their financial health, without the delays of manual reporting.

Enhanced Security

Financial data is highly sensitive, and manual accounting methods often lack sufficient security measures. Automated systems, particularly those based in the cloud, offer robust encryption and data protection features, reducing the risk of fraud or data breaches. This security improvement is essential as businesses increasingly rely on digital platforms to manage their finances.

Popular Automated Accounting Software Solutions

With so many options available, choosing the right automated accounting software can feel overwhelming. To help narrow it down, here are five of the best accounting software solutions you can adapt:

QuickBooks

QuickBooks is a widely adopted accounting software, known for its intuitive interface and robust automation capabilities. It automates tasks such as invoicing, bill payments, and payroll management, making it a great choice for small to medium-sized businesses.

QuickBooks offers both online and offline versions to cater to different business needs.

The online version of QuickBooks is cloud-based, allowing users to access their accounts anytime, anywhere with an internet connection. It offers five plans—Simple Start, Essentials, Plus, Advanced, and Self-Employed—each with different features and user capacities, increasing in price and functionality to meet varying business needs.

The online version is ideal for businesses prioritizing remote access, real-time collaboration, and automatic updates.

The offline version, called QuickBooks Desktop, is an accounting software you download and install on your computer. It’s best for businesses that don’t need real-time collaboration and prefer storing data locally.

Xero

Xero offers a cloud-based platform that integrates smoothly with other business systems like payroll and CRM tools. Its automation features include bank reconciliation, automated invoicing, and real-time financial reporting. This makes it an ideal solution for businesses looking for a comprehensive platform to manage their accounting processes in one place.

QNE Software

QNE Software is made to fit the accounting needs of businesses in the Philippines. It is a popular choice for accountants and business owners because it offers tools like accounting software, payroll systems, digital portals, and cloud-based solutions.

All its products follow BIR rules, making tax management easier. QNE works well for many industries by helping with financial tasks and tax compliance.

Zoho Books

Zoho Books is a comprehensive accounting solution tailored for small and medium-sized businesses. It offers features such as invoicing, expense tracking, inventory management, and automated workflows.

With its cloud-based platform, Zoho Books allows users to access their financial data anywhere, making it ideal for businesses looking to manage finances efficiently in a modern, flexible environment.

SAP Business One

SAP Business One is a top ERP solution for small and medium businesses. It combines key operations like finance, customer management, purchasing, inventory, and production planning.

Known globally for its reliability, SAP helps businesses streamline tasks and make smarter decisions with its advanced features.

NetSuite

NetSuite is a comprehensive cloud-based ERP system that offers a range of accounting automation features, including real-time financial tracking, invoice automation, and tax management.

It’s well-suited for businesses that require advanced financial management tools integrated with broader business systems, such as inventory and customer relationship management (CRM) platforms.

SolveXia

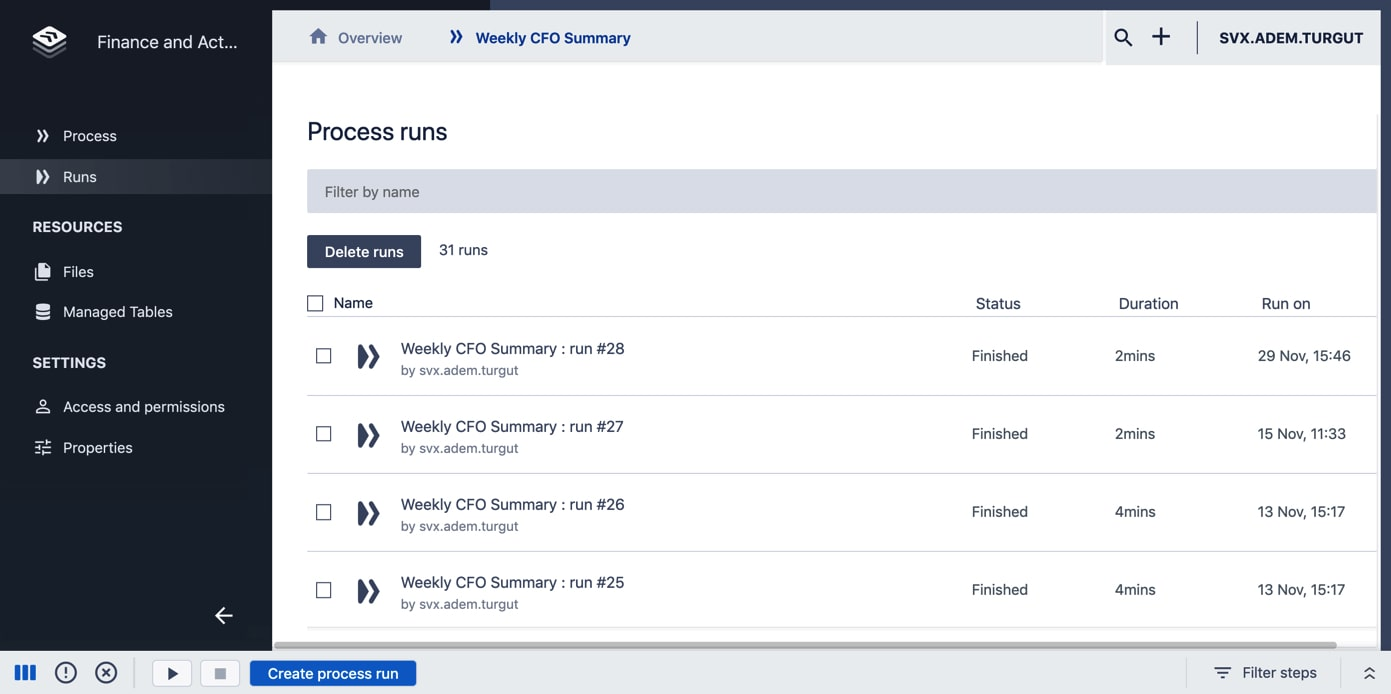

Solvexia’s platform screen showing automated processes with their status, duration, and completion details

SolveXia specializes in automating repetitive financial tasks such as data reconciliation, report generation, and workflow management. It’s particularly valuable for businesses looking to improve operational efficiency while reducing manual errors.

SolveXia is highly flexible and integrates with a range of financial systems, making it a powerful tool for accounting automation.

BlackLine

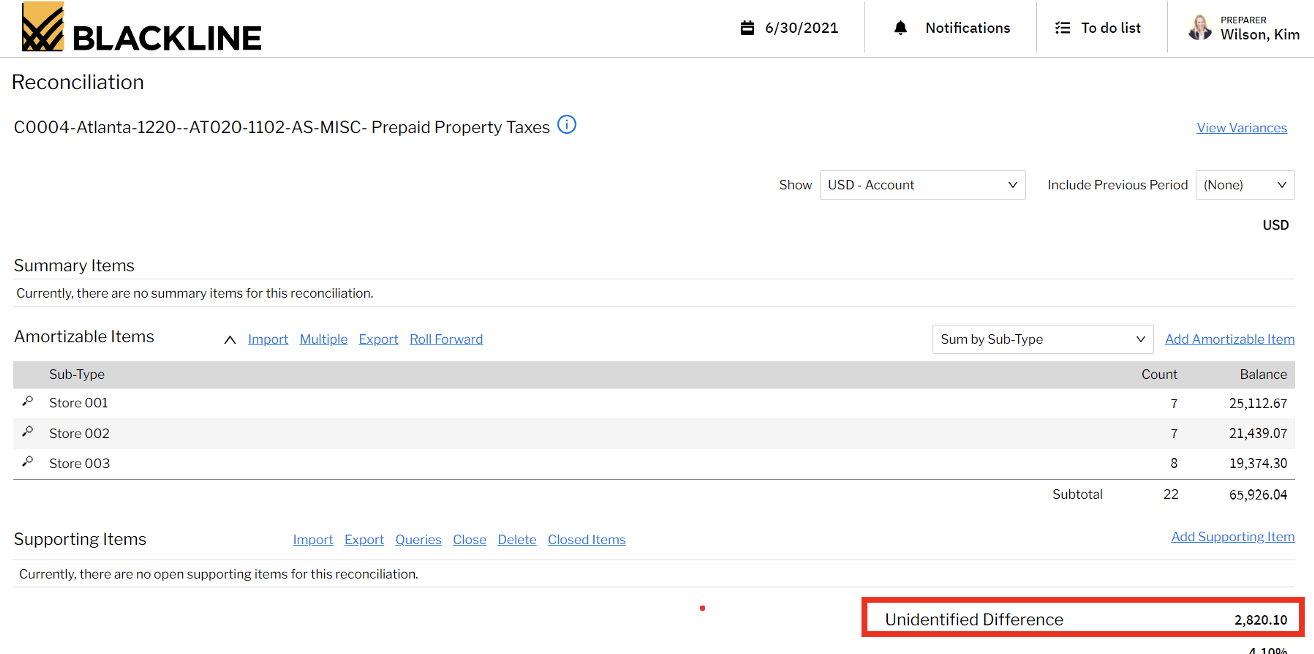

BlackLine reconciliation screen displaying amortizable items, subtotal details, and a highlighted unidentified difference section

BlackLine is a leading software solution for automating complex accounting tasks, particularly around financial close processes. Its features include automated journal entries, account reconciliation, and transaction matching.

BlackLine is designed to help larger enterprises ensure compliance, improve accuracy, and reduce the time spent on manual accounting tasks.

How to Get Started with an Automated Accounting System

Here’s a step-by-step guide to help you successfully implement an automated accounting system for your business:

Implementing an Automated Accounting System

Step 1: Conduct a Needs Assessment

Before implementing an automated accounting system, assess your current processes to identify which tasks could benefit most from automation. For example, if you’re spending too much time on invoicing or reconciling accounts, these areas might be prime candidates for automation.

Step 2: Research and Select Software

Next, research different automation solutions that match your business needs. Consider features like scalability, integration with existing systems, and the software’s ability to handle industry-specific tasks. It’s also important to choose software that offers strong security features, as financial data protection is critical.

Step 3: Create a Demo Trial

Before fully committing to a system, set up a demo trial to test the software’s features and compatibility with your business needs. This step allows you to evaluate its user-friendliness, functionality, and how well it integrates with your existing tools.

Step 4: Train Your Team

Automation requires a shift in how your team handles accounting tasks. Training is essential to ensure your staff is comfortable using the new system and can maximize its features. A well-trained team will quickly adapt to the new processes, making the transition to automation smooth.

Step 5: Continuous Monitoring and Optimization

Once your automated accounting system is in place, continuous monitoring is key to maintaining accuracy and efficiency. Regularly review system performance and look for areas where further automation or optimization can improve your financial processes.

Read More: 5 Benefits of Outsourcing Accounting in the Philippines

Outsource Your Accounting to Babylon2K for Maximum Efficiency

Outsourcing your accounting to Babylon2K is one of the best ways to maximize efficiency and stay competitive in today’s fast-paced business environment. Our accounting services allow you to focus on growing your business while we handle the complex, time-consuming financial tasks.

With our cutting-edge technology and expert team, you’ll benefit from improved accuracy, real-time financial insights, and reduced operational costs.

Request a quote, and let us support your business’s growth and financial health today.

For more inquiries, message our AI chatbot, email us at [email protected], or contact us via Viber/WhatsApp at +63-927-945-3382.

4 Responses

Very informative. Really enjoyed walking us through the tricks! ✨ 👏

This post is a great starting point for anyone new to the subject.

Pretty! This has been a really wonderful post. Many thanks for providing these details.

We’ve been exploring different property management programs, and Renter ERP seems like a complete solution — especially for handling rent collection and maintenance tracking.