The Bureau of Internal Revenue (BIR) of the Philippines recently issued Revenue Memorandum Circular (RMC) No. 19-2024, providing valuable clarification on the tax treatment of interest expenses. This circular aims to guide individuals, businesses, and tax professionals in understanding the proper recognition, capitalization, and deduction of interest expenses for tax purposes.

Importance of Understanding Interest Expense Tax Treatment

Interest expenses play a significant role in the financial landscape of individuals and businesses. Recognizing and managing these expenses is crucial for tax compliance and effective tax planning. By understanding the tax treatment of interest expenses, taxpayers can ensure accurate reporting, optimize deductions, and avoid potential penalties or audits.

Differences between Accounting Treatment and Tax Treatment

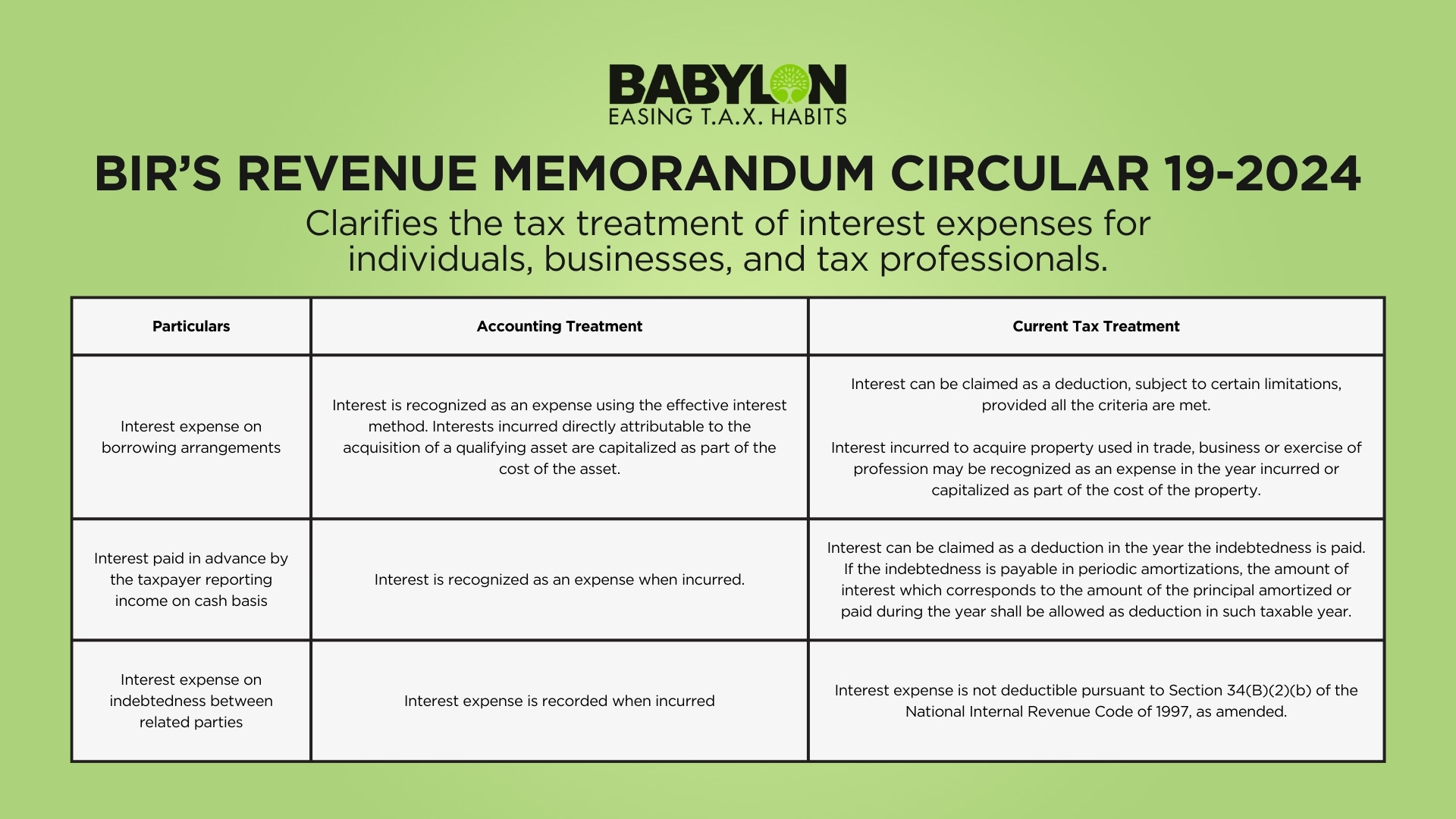

The RMC highlights the critical differences between the accounting treatment and the current tax treatment of interest expenses. It is essential to distinguish between the two to ensure compliance with Philippine tax regulations. The table below summarizes these differences:

| Particulars | Accounting Treatment | Current Tax Treatment |

| Interest expense on borrowing arrangements | Recognized as an expense using the effective interest method. Interests incurred directly attributable to the acquisition of a qualifying asset are capitalized as part of the asset’s cost. | Claimed as a deduction, subject to certain limitations, provided all criteria are met. |

| Interest incurred to acquire property used in trade, business, or exercise of profession | Recognized as an expense in the year incurred or capitalized as part of the cost of the property. | Capitalized for tax purposes only if the asset is used in trade, business, or exercise of profession, not if it is intended for sale. |

| Interest paid in advance by cash-basis taxpayers | Recognized as an expense when incurred. | Deducted in the year, the indebtedness is paid, corresponding to the principal amortized or paid during the year. |

| Interest expense on indebtedness between related parties | Recorded when incurred. | Not deductible as per Section 34(B)(2)(b) of the National Internal Revenue Code. |

Understanding these distinctions is crucial for accurately reporting interest expenses and maximizing tax deductions.

Capitalization of Borrowing Costs

The RMC also sheds light on capitalizing borrowing costs, which are interest and other costs incurred with borrowing funds. The Philippine Financial Reporting Standards require an effective interest method to calculate interest expenses. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are capitalized as part of the asset’s cost. All other borrowing costs are recognized as an expense when incurred.

To commence capitalization, three conditions must be met: the entity incurs expenditures for the asset, incurs borrowing costs, and undertakes activities necessary to prepare the asset for its intended use or sale. Capitalization ceases when substantially all activities required to prepare the qualifying asset are complete.

Deductibility of Interest Expenses

The RMC clarifies the deductibility of interest expenses incurred concerning the taxpayer’s trade, business, or profession. To claim a deduction, the following requisites must be met:

- The indebtedness must be that of the taxpayer.

- The interest must have been stipulated in writing.

- The interest must be legally due.

- The interest payment arrangement must not involve related taxpayers.

- The interest must not finance petroleum operations.

- The interest must not be treated as a capital expenditure.

- The interest shall be reduced by 20% of interest income subjected to Final Tax.

Appropriate tax withholding is required to fully claim the interest expense deduction.

Capitalizing Interest Expenses for Tax Purposes

Taxpayers may elect to capitalize interest expenses incurred to acquire property used in trade, business, or exercise of profession. The option to capitalize interest expense is irrevocable per specific asset/property. The interest expense shall be proportionately capitalized on each property if multiple loans cover acquiring several properties.

For general borrowings covering the acquisition of assets used in trade, business, or exercise of profession, only the interest expense directly attributable to the acquisition may be capitalized. The option to capitalize interest expense must be applied consistently for all loans related to a particular property.

When capitalizing interest expense, it should be depreciated or amortized based on the asset’s useful life. Depreciation or amortization begins upon the acquisition of the property or when it is ready for its intended use. However, if the property still needs to be prepared, depreciation or amortization starts when the property is ready for use.

It’s important to note that if interest expense is treated as a capital expenditure, only periodic depreciation or amortization can be claimed as a deduction from gross income.

Prepaid Interest and its Tax Treatment

The RMC addresses the tax treatment of prepaid interest. Suppose an individual taxpayer on a cash basis incurs an indebtedness on which interest is paid in advance. In that case, the interest expense deduction is allowed when the taxpayer fully pays the debts. The corresponding interest expense is deducted in the taxable year for periodic amortizations.

Under the accrual method of accounting, interest expense is deductible in the year paid or accrued. However, if a corporation prepays interest at the loan drawdown date, the prepaid interest should be amortized over the required period. The amortized portion is deducted from the prepaid interest as an expense for the taxable year within the necessary period.

Limitations and Withholding Tax Rates

Interest expense deductions are subject to certain limitations and withholding tax rates. The RMC specifies the following rates:

- Final withholding tax of 25% on interests paid to non-resident aliens not engaged in trade or business in the Philippines.

- Final withholding tax of 20% on interests from foreign currency loans paid to non-resident foreign corporations unless a lower rate applies under an existing treaty.

- Final withholding tax of 10% on interests from foreign currency loans paid by residents other than offshore banking units or depository banks under the expanded foreign currency deposit system.

- Creditable withholding tax of 15% on interests from other debt instruments not classified as “deposit substitutes” under relevant regulations paid to residents, except for specific cases subject to a 2% withholding tax rate.

Complying with these rates and fulfilling the withholding requirements is essential.

Ensuring Compliance and Effective Tax Planning

Understanding the tax treatment of interest expenses is vital for individuals and businesses of all sizes. By adhering to the guidelines provided in Revenue Memorandum Circular No. 19-2024, taxpayers can ensure compliance with Philippine tax regulations, optimize their deductions, and effectively plan their tax liabilities.

If you would like more clarification or specific questions, it is best to consult with tax professionals like Babylon2k or UHY M.L. Aguirre or contact the BIR directly.

Disclaimer: This article is for informational purposes only and should not be considered legal or tax advice. Always consult a qualified tax professional for personalized advice regarding your circumstances.

Schedule a FREE call with Babylon2k.org today for expert guidance on tax compliance and other financial matters 👉 https://bit.ly/b2k-demo