As year-end approaches, Philippine taxpayers must prepare for the upcoming series of mandatory filings and compliance requirements due within the first month of the upcoming year. These submissions are required by the Bureau of Internal Revenue (BIR) and Local Government Units (LGUs).

To help businesses, employers, and professionals stay on track — here is a rundown of the practical year-end checklist of obligations you shouldn’t miss in January.

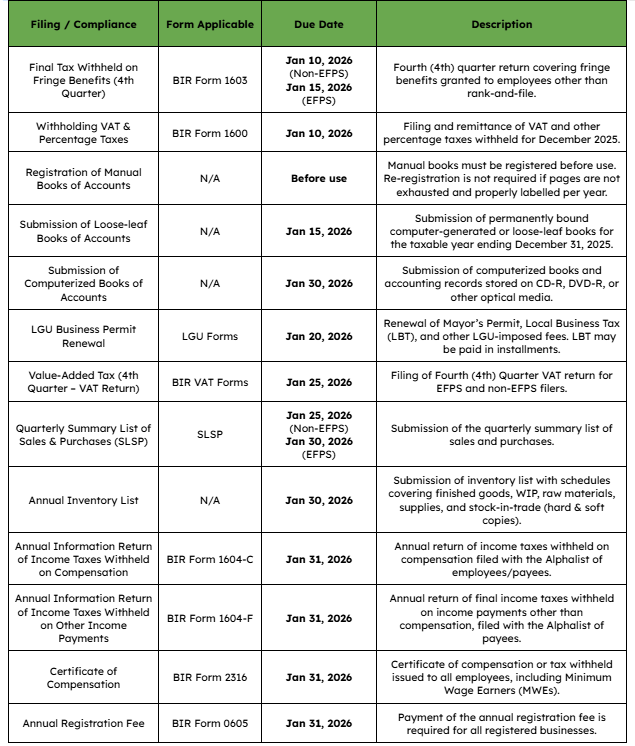

Dates to Look Out For

Conclusion

The first month of the upcoming year sets the tone for your overall compliance and financial health. With several tax filings, registrations, and reporting requirements due in January, early preparation is the key to avoiding penalties, delays, and unnecessary stress. Staying organized and informed allows businesses to focus on growth while remaining fully compliant with BIR and LGU regulations.

If you or your business need assistance with tax filings, compliance reviews, bookkeeping, or year-end reporting, Babylon2k’s accounting and tax professionals are ready to help.

Start the year compliant, confident, and stress-free — partner with Babylon2k today!